Active

This profile is actively maintained

Active

This profile is actively maintained| Website | http://www.kbfg.com |

| Headquarters |

26, Gukjegeumyung-ro 8-gil, Yeongdeungpo-gu

Seoul

South Korea

|

| CEO/chair |

Yang Jong Hee Chairman & CEO |

| Supervisor | |

| Ownership |

listed on Korea Exchange

KB Financial Group's largest shareholder is the National Pension of Korea (8.679%). KBFG's complete shareholder structure can be accessed here. |

| Subsidiaries |

KB Kookmin Bank – South Korea

|

KB Financial Group (KBFG), founded in September 2008 and headquartered in Seoul, South Korea is a holding company that engages in providing financial services. Its main subsidiary is KB Kookmin Bank. KB Financial Group provides corporate, retail and personal banking services and is also involved in insurance and asset management.

KB Financial Group's most important sustainability commitments can be found at the website sections listed below.

Links

KB Financial Group is linked to a number of companies and projects that BankTrack considers controversial (so called Dodgy Deals), e.g. as a current or past financier or through an expression of interest. The profiles below provide more details on the nature of KB Financial Group's link to these deals.

KB Financial Group mentions in its 2016 Human rights report a grievance mechanism for "those affected by adverse human rights impacts caused during the course of its business operations", but KBFG does not list contact details on its website.

KB Financial Group is an Equator Principles signatory. While the Equator Principles have no official grievance mechanism, complaints relating to this bank's financing of Equator Principles projects can be filed through our own website www.equator-complaints.org.

This page evaluates KB Financial Group's responses to instances of alleged human rights violations linked to its finance, raised by civil society organisations. It is not intended to be exhaustive, but covers selected impacts raised by BankTrack and other civil society partners since 2016. For the full scoring methodology, see here. For more information about BankTrack's evaluation of bank responses to human rights impacts, see the 2021 report "Actions speak louder: assessing bank responses to human rights violations".

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 200

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 200

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 209

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 209

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 217

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 217

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 220

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 220

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 223

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 223

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

Banks and Climate

The 2025 Banking on Climate Chaos report showed that KB Financial Group provided $5.0 bn in financing to the fossil fuel industry between 2021 and 2024. In 2024 only, KB Financial Group provided $1.6 bn, including $1.2 bn for oil, gas and coal companies expanding fossil fuels. Find further details on KB Financial Group's fossil fuel portfolio and how it compares to other large banks globally on the Banking on Climate Chaos website below.

Partner organisation Reclaim Finance tracks the coal, oil and gas policies of financial institutions, including banks, in their Coal Policy Tool (CPT) and the Oil and Gas Policy Tracker (OGPT). BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of KB Financial Group’s fossil fuel policy below.

Banks and Human Rights

BankTrack assessed KB Financial Group in its 2022 Human Rights Benchmark Asia, where it achieved 4 points out of 14 and was ranked as a follower. More information is detailed in the "Accountability" section of this profile.

Human Rights Benchmark Asia 2022

Tracking the Net Zero Banking Alliance

KB Financial Group is a member of the Net Zero Banking Alliance (NZBA) and has therefore committed to reduce its financed emissions to net zero by 2050; within 18 months of joining the alliance set interim targets for 2030 (or sooner) for high emission priority sectors, and within 36 months set further sector targets; set new intermediary targets every 5 years from 2030 onwards; annually publish data on emissions and progress against a transition strategy including climate-related sectoral policies; and take a robust approach to the role of offsets in transition plans. BankTrack track's implementation of these commitments in the NZBA compliance tracker.

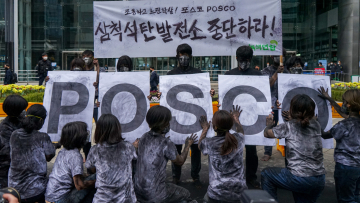

Banks and Steel

As part of the Net Zero Banking Alliance (NZBA), KB Financial Group is required to set interim targets for 2030 for high emission priority sectors. For KB Financial Group, this includes its lending to the steel sector. You can see KB Financial Group’s iron and steel decarbonisation targets, and its progress towards meeting them in our NZBA steel targets compliance tracker:

Partner organisation Reclaim Finance tracks the metallurgical coal policies of financial institutions, including banks, in their Coal Policy Tool. BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of KB Financial Group’s metallurgical coal policy below.

According to a report by Reclaim Finance, between 2016 and June 2023, KB Financial Group provided $2.7 billion in finance to the fossil-steel industry, making it the 49th largest financier worldwide. Find further details on KB Financial's steel financing and how it compares to other large banks globally in the report.