Active

This profile is actively maintained

Active

This profile is actively maintained| Website | http://www.ocbc.com/ |

| Headquarters |

65 Chulia Street, OCBC Centre

049513

Singapore

|

| CEO/chair |

Helen Wong Group CEO |

| Supervisor | |

| Ownership |

listed on Singapore Stock Exchange (SGX)

OCBC Bank's largest shareholder is Citibank (17.02%). The bank's complete shareholder structure can be accessed here. |

OCBC Bank is Singapore's oldest bank. It was formed through the merger of three local banks in 1932. It is currently Singapore's second largest banking group by assets. The bank operates in 15 countries and offers financial services that include retail banking, private banking, insurance, asset management, international trade financing and stockbroking.

OCBC Bank's most important sustainability commitments can be found at the website sections listed below.

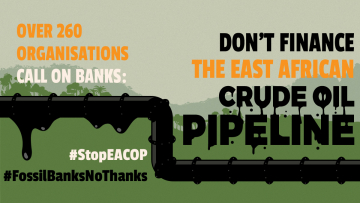

OCBC Bank is linked to a number of companies and projects that BankTrack considers controversial (so called Dodgy Deals), e.g. as a current or past financier or through an expression of interest. The profiles below provide more details on the nature of OCBC Bank's link to these deals.

OCBC Bank operates a Feedback, Complaints & Enquiries channel, which can be accessed here.

OCBC Bank is an Equator Principles signatory. While the Equator Principles have no official grievance mechanism, complaints relating to this bank's financing of Equator Principles projects can be filed through our own website www.equator-complaints.org.

This page evaluates OCBC Bank's responses to instances of alleged human rights violations linked to its finance, raised by civil society organisations. It is not intended to be exhaustive, but covers selected impacts raised by BankTrack and other civil society partners since 2016. For the full scoring methodology, see here. For more information about BankTrack's evaluation of bank responses to human rights impacts, see the 2021 report "Actions speak louder: assessing bank responses to human rights violations".

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 200

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 200

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 209

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 209

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 217

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 217

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 220

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 220

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

A PHP Error was encountered

Severity: Warning

Message: Division by zero

Filename: bankprofile/response_tracking.php

Line Number: 223

Backtrace:

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/response_tracking.php

Line: 223

Function: _error_handler

File: /home/btwebhost/www/btci3/application/helpers/easy_helper.php

Line: 366

Function: view

File: /home/btwebhost/www/btci3/application/views/sections/bankprofile/main.php

Line: 270

Function: lv

File: /home/btwebhost/www/btci3/application/libraries/sections/Bankprofile.php

Line: 531

Function: view

File: /home/btwebhost/www/btci3/application/controllers/Main.php

Line: 331

Function: content

File: /home/btwebhost/www/btci3/index.php

Line: 321

Function: require_once

Banks and Climate

Partner organisation Reclaim Finance tracks the coal, oil and gas policies of financial institutions, including banks, in their Coal Policy Tool (CPT) and the Oil and Gas Policy Tracker (OGPT). BankTrack works closely with Reclaim Finance and endorses their policy assessments. Find further details on their assessment of OCBC Bank’s fossil fuel policy below.

Banks and Human Rights

BankTrack assessed OCBC Bank in its 2022 Human Rights Benchmark Asia, where it achieved 1.5 points out of 14 and was ranked as a 'laggard'. More information is detailed in the "Accountability" section of this profile.

Human Rights Benchmark Asia 2022

Banks and Nature

OCBC Bank’s policies for forest-risk sectors (beef, soy, palm oil, pulp and paper, rubber and timber) have been assessed by the Forests & Finance coalition, achieving an overall score of 2 out of 10 and ranking it as a follower. OCBC Bank achieved a score of 1.8 out of 10 specifically for its policies related to the beef sector and 2 out of 10 for its policies related to the palm oil sector. Between 2016 and 2022, OCBC Bank provided USD 5,337 million in credit to companies operating in these forest-risk sectors and held investments amounting to USD 359 million as of 2022. For more information, see the links below.

Forest & Finance Policy Assessment 2022: Overall scores

A bank can obtain a total of 10 points for the quality of its policies. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Forest & Finance Policy Assessment 2022: Beef

A bank can obtain a total of 10 points for the quality of its beef policy. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Forest & Finance Policy Assessment 2022: Palm Oil

A bank can obtain a total of 10 points for the quality of its palm oil policy. The total score is based on their scores per sector, weighted against their financing and investment for each sector. For further details on this see here. Based on their overall score, banks are then classified as Laggards, Followers, Front runners or Leaders, as follows:

Tracking the Net Zero Banking Alliance

OCBC Bank is a member of the Net Zero Banking Alliance (NZBA) and has therefore committed to reduce its financed emissions to net zero by 2050; within 18 months of joining the alliance set interim targets for 2030 (or sooner) for high emission priority sectors, and within 36 months set further sector targets; set new intermediary targets every 5 years from 2030 onwards; annually publish data on emissions and progress against a transition strategy including climate-related sectoral policies; and take a robust approach to the role of offsets in transition plans. BankTrack track's implementation of these commitments in the NZBA compliance tracker.