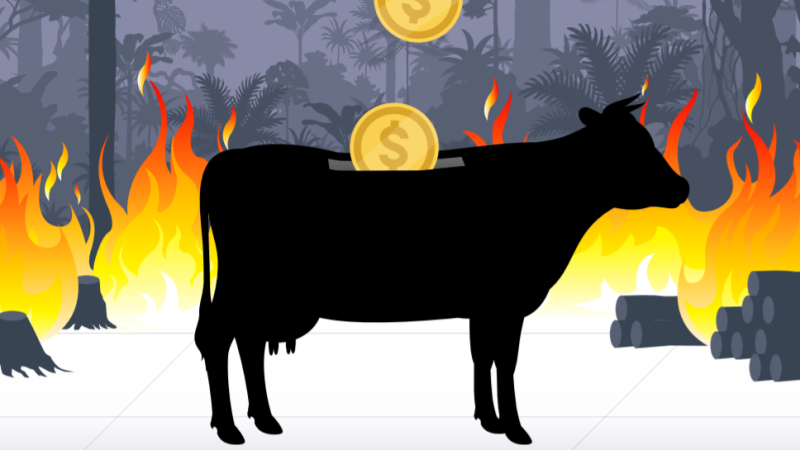

Major global banks complicit in widespread destruction of the Amazon rainforest linked to Brazilian beef companies, and international audits flawed

A new report from Global Witness shows how major Brazilian meat traders are failing to remove huge swathes of Amazon deforestation from their supply chains, which flawed audits by DNV-GL and Grant Thornton then did not pick up. Meanwhile, big banks like Barclays, Morgan Stanley, HSBC and Santander continue backing them, despite many warnings of their destructive practices.

Global Witness reveals today that international auditors DNV-GL and Grant Thornton have effectively legitimised devastating illegal deforestation by three of the world’s largest beef producers - JBS, Marfrig and Minerva. Today’s report is the first systematic analysis of these beef companies’ audits, exposing how the auditors have failed to identify the scale and regularity of deforestation in supply chains. Our findings show that tens of thousands of football fields’ worth of deforestation was contained in the ranches linked to these meat traders between 2016 and 2019, contravening their legal obligations and the terms of non-prosecution agreements they have with Federal Prosecutors in Brazil.

JBS, Marfrig and Minerva’s environmental destruction was rewarded by major UK, EU and US-based banks that financed them to the tune of almost $4bn over the period analysed. Household names such as Deutsche Bank, Santander, Barclays, Morgan Stanley, BNP Paribas, ING and HSBC all seemingly failed to do meaningful due diligence on their exposure to this deforestation, and continue backing the companies today despite many warnings of their failures. The beef sold by these companies is also ending up on the shelves of well-known high street stores and brands, including Burger King, Sainsbury’s, Subway, McDonalds, Walmart, Carrefour, and Nestle, exposing consumers to the risk that the products they buy are linked to the destruction of the Amazon.

“Global Witness’s investigation lifts the lid on how a system of complicity, wilful blindness and incompetence has grown up around industrial beef production. We see it at every point along the global supply chain,” said Chris Moye, Senior Amazon Forests Investigator at Global Witness. “Every player - from the ranches that raise cattle, to the goliaths of Brazil’s beef industry, their iconic financial backers, supermarkets, importers and fast-food chains - are either destroying rainforests or are complicit in their destruction, with flawed audits undertaken by US and European auditors,” he continued.

“These actors cannot plead ignorance - backing beef supply chains in the middle of the Amazon is a predictably high-risk business, especially when you are dealing with companies with very poor environmental track records like JBS, Marfrig and Minerva. If your business is failing to do proper due diligence and profiting from these meat traders’ destructive practices, you are part of the problem,” Moye added.

Using satellite imagery, geospatial analysis, cutting-edge data mining, publicly available documents and source interviews, Global Witness’s new investigation Beef, Banks and the Brazilian Amazon, found that:

- Between 2017 and 2019, JBS, Marfrig and Minerva bought cattle directly from a combined 379 ranches containing 20,000 football fields’ worth of illegal deforestation in the Amazon state of Pará

- These three beef companies failed to monitor an additional 4,000 ranches further down their supply chains, which contained an estimated total of 140,000 football fields’ worth of deforestation

- JBS and Marfrig bought cattle from ranchers accused by Brazilian prosecutors of land grabbing, human rights abuses linked to indigenous peoples and land rights activists, and the murder of landless workers’ movement representatives

- Flawed assessments by mammoth Norwegian auditor DNV-GL and its American rival Grant Thornton claimed JBS, Marfrig and Minerva were compliant with their no-deforestation commitments, failing to flag a vast number of cases of sourcing from deforested areas

- Major banks with no-deforestation commitments did not scrutinise or question the flawed audit reports or egregious records of these beef companies, and continued bankrolling them

These findings come as the Amazon is being destroyed at an alarming rate, with the rollback of forest protections by the Bolsonaro government, reduced enforcement during COVID-19, and another devastating fire season creating a perfect storm. Deforestation in the Brazilian Amazon has risen dramatically throughout 2019 and 2020, making both years the highest rate of deforestation since 2008. A massive 70% of this destruction has been caused by land being cleared for cattle ranching. Beef production in Brazil is reported to be the leading driver of deforestation emissions across the entirety of Latin America.

“The auditors, financiers and retailers linked to the rapacious Amazon deforestation being carried out by these beef giants are all helping fuel the destruction of this vital ecosystem and carbon sink, implicating faraway customers and bank account holders in the process,” said Moye.

“From cattle ranch to consumers’ baskets, this system is broken. Our investigation clearly demonstrates that relying on an unregulated private sector with voluntary no-deforestation policies has failed to tackle forest destruction and related human rights abuses. This could contribute to the permanent loss of the Amazon rainforest,” Moye added.

Preserving tropical rainforests is critical to help stop climate breakdown and to protect the local communities and indigenous people who depend on and defend them. Moreover, the Covid-19 pandemic has brought into sharp relief the importance of preserving biodiversity hotspots like the Amazon in order to prevent the spread of zoonotic diseases.

In the absence of the necessary laws in consumer countries and financial hubs like Europe and the US, banks, investors, credit rating agencies, importers and supermarkets can continue profiting from devastating deforestation and face no consequences.

“Governments must take action and ensure that all businesses, including banks, are held accountable for their role in the destruction of the Amazon by requiring mandatory due diligence on deforestation risk,” Moye concluded.

The UK government recently introduced draft legislation prohibiting the use of certain commodities associated with deforestation by large companies and requiring them to undertake due diligence on deforestation risk in their supply chains. However, these proposals currently fall short as they let finance off the hook and allow forest destruction to continue as long as it is deemed ‘legal’ under local laws. The EU is currently consulting on potential new rules on deforestation in EU supply chains. Global Witness is calling on the UK and EU to ensure these laws are fit for purpose.

Global Witness is also calling on JBS, Marfrig and Minerva to adopt full supply chain transparency in order to enable public scrutiny of which ranches they buy cattle from. Until such measures are in place, no financier or buyer can rely on company assurances that their forest-related commitments are in place.

All of the beef companies, banks and auditors featured in the report were approached for comment (see Notes to editor below).

Notes to editors:

- JBS, Marfrig and Minerva have pledged not to purchase cattle from ranches that contained any deforestation that occurred after October 2009, that were embargoed by Brazil’s environmental inspection agency Ibama, or that overlapped into protected areas or indigenous community lands. JBS and Minerva also have non-prosecution agreements with environmental Federal Prosecutors in the Amazon state of Pará, to not source cattle from ranches with illegal deforestation that occurred after July 22nd 2008.

- The report also details various ongoing financial relationships between major EU and US banks and the beef companies, despite being warned many times of their failures on deforestation. For example, in 2019 BNP Paribas, ING Bank and Santander led on the sale of Marfrig’s controversial sustainable ‘transition bonds’ that would permit the company to invest more on its Amazon based slaughterhouses, despite its decade-long failure to remove vast swathes of Amazon deforestation from its supply chains. Meanwhile Barclays’s stated commitments to forests did not prevent it from underwriting four overseas bond deals since 2017 for JBS worth a combined $2.75 billion, despite the company being linked many times to Amazon deforestation and despite its involvement in major corruption investigations linked to the massive Car Wash scandal. The banks’ responses to the new findings in the report illustrate their continued failure to exercise adequate due diligence.

- JBS was offered the opportunity to comment on its exposure to 327 ranches that Global Witness claimed it purchased cattle from between 2017 and 2019 and which contained illegal deforestation. The company provided justifications for each ranch, claiming that in 94% of the cases these were compliant with their legal and voluntary no-deforestation pledges, and in 6% of the cases they claimed they did not register cattle purchases from the ranches that were sent to them. Global Witness evaluated all these explanations and found them inadequate, standing by the original allegations (see report for details)

- Marfrig was offered an opportunity to comment on its exposure to 89 ranches Global Witness claimed it purchased from between 2017 and 2019 and which contained illegal deforestation. It claimed that 84 of the ranches were compliant with its voluntary and legal no-deforestation pledges and that it was unable to identify cattle purchases from five ranches according to the information that was sent. Global Witness in turn, evaluated all of these explanations and found each justification to be invalid (see report for more details).

- Minerva was offered an opportunity to comment on its exposure to 16 ranches Global Witness claimed it purchased from between 2017 and 2019 and which contained illegal deforestation. It claimed 13 of the ranches were compliant with its voluntary and legal no-deforestation pledges, and that the company did not register purchases from three of them. Global Witness in turn evaluated all the justifications, and found them to be invalid, standing by the initial allegations (see report for more details).

- In their responses to opportunity to comment letters, the auditors DNV-GL and Grant Thornton claimed that restrictions on the audits may have impeded them from unearthing the cases found by Global Witness.

- When asked for comment, all of the banks mentioned in the report defended their relationship with the meat traders.