One silver lining in otherwise disappointing shareholder season at big US banks

This spring, investors from major asset managers to state pension funds had the opportunity to weigh in on some of the most important climate votes of the year during companies’ annual shareholder meetings. These votes included calling on companies ranging from oil producers to banks to adopt stronger climate targets and disclose how they plan to decarbonize. At the big US banks, investors voted on shareholder proposals to phase down their financing of fossil fuel expansion, strengthen their emissions reduction targets, and disclose business plans to align with their near-term emissions targets.

The results of this year’s annual shareholder meetings were largely underwhelming, with investors deciding to take a hands-off approach to corporate action on climate change. There was one silver lining, with unprecedented levels of support for proposals calling on banks to disclose how they plan to meet their climate commitments.

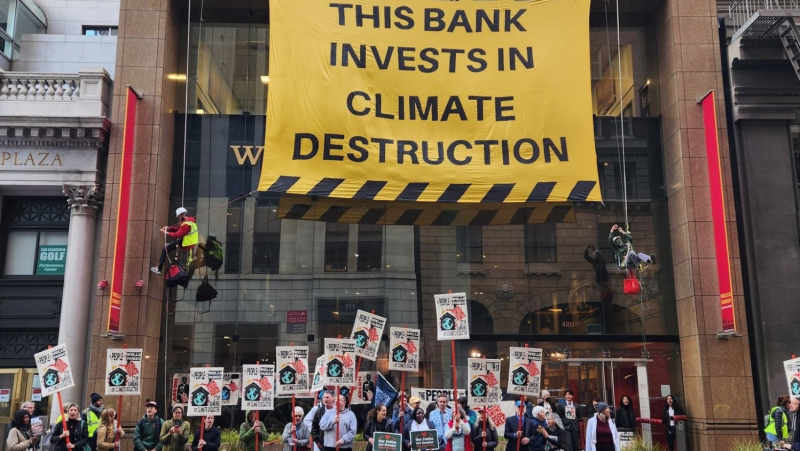

These types of shareholder proposals at big corporations are necessary for many reasons. The negative impacts of the climate crisis are mounting faster than scientists predicted, and the world is on track to hit 1.5C of warming before the end of the decade. Despite the growing number of corporate climate pledges, financial institutions — including banks, asset managers, and pension funds — continue to pour billions of dollars into companies engaging in fossil fuel expansion. The 6 biggest US banks are among the top global financiers of fossil fuels, providing more than US$ 1.6 trillion to fossil fuel companies since the Paris Agreement. That’s more than 3x the valuation of Exxon Mobil.

This year, climate-conscious investors looking to escalate accountability for the role US banks play in fueling the climate crisis filed three shareholder resolutions calling for stronger action on climate.

- Phase out financing for companies expanding fossil fuels. These resolutions called on banks to adopt policies to phase out financing for companies engaging in fossil fuel expansion. This is the most direct way banks can ensure they are reducing climate pollution and putting guardrails on their financing for transition-related activities.

- Adopt stronger emissions reduction targets. These resolutions urged banks to adopt stronger climate targets by setting goals to reduce their absolute financed emissions by 2030 for energy and utility companies. These targets are essential to ensure banks’ climate strategies actually translate into real-world emissions reductions.

- Disclose a plan to meet climate goals. These resolutions called on banks to disclose plans for how they will hit their existing 2030 climate targets. Without this information, investors have no reassurance that banks are actually taking necessary steps in this crucial decade to keep their commitments and reduce their climate impacts.

The range of resolutions suggests that many climate-conscious investors are eager to see real accountability. Yet the voting response from global investors demonstrated that the financial sector is falling far short of where it should be in managing and mitigating climate risks.

This year’s support for climate resolutions was largely underwhelming.

On average, the resolutions on phasing out fossil fuels received between 5-8% support from shareholders, while the resolutions on stronger climate targets averaged nearly 12% support.

This underwhelming support indicates investors still aren’t recognizing the urgent need to use their shareholder power to push companies to slash emissions — and therefore protect investor returns for the long run. Rather than urging companies to make changes to meet their own climate goals and help mitigate the impacts of the climate crisis, investors chose to be timid and deferential to laggard companies at a time when more forceful stewardship and action is needed.

Investors are focused on demanding companies disclose their plans to meet their climate commitments, but not make them stronger.

This year’s annual shareholder meetings of big US banks had one silver lining. Investors rallied around resolutions calling on banks to disclose their transition plans to achieve their 2030 emissions targets, with these resolutions garnering an average 31% support at Bank of America, Wells Fargo, Goldman Sachs, and JPMorgan Chase. This strong level of support for these first-of-their-kind resolutions signals that investors are tired of banks greenwashing their climate commitments, and that investors want proof banks will actually follow through on their emissions reduction pledges.

There’s no question this is an important step forward. But the fact of the matter is that more disclosure of companies’ plans to enact their insufficient targets won’t do nearly enough to address the climate crisis. These transition plans can be a helpful step for transparency and accountability, but ultimately these banks need to have targets that match the urgency of the climate crisis, and demonstrate progress meeting them.

As we wrap up this year’s season of climate votes at US companies and turn to what’s next, a few things become apparent:

- Big US banks would be wise to start providing more detailed plans for implementing their climate commitments, as both their shareholders and financial regulators are looking to understand the rigor and credibility of these strategies.

- Investor support for resolutions calling for companies to disclose transition plans should be a signal to federal regulatory agencies like the Securities and Exchange Commission that it needs to finalize and implement strong requirements on climate-related disclosures. Right now, the SEC is considering a climate risk disclosure rule that would require public companies — including big US banks — to disclose plans for hitting the climate-related goals they’ve set.

- All investors — but especially pension funds with long-term commitments to provide returns for its plan beneficiaries — need to start voting like their investment security depends on it, because it does. This means using their shareholder power to push companies to cut emissions faster, not just to explain the plans they have. And if funds have asset managers voting on their behalf, they should demand these asset managers vote for their clients’ long-term interests — or take their business elsewhere if they won’t.

Despite a largely disappointing shareholder season, our movement remains committed to holding the financial sector accountable for its role in the climate crisis. Join the growing movement continuing to build pressure on the biggest funders of climate chaos to protect our future: Tell America’s Largest Banks: Stop Funding Fossil Fuels!

Reposted from www.sierraclub.org