Global banks commit to net-zero, but bankroll carbon bomb in Australia

Euijin Kim,

Communications Officer,

Solutions for Our Climate

Helen Burley,

International Media,

Reclaim Finance

Euijin Kim,

Communications Officer,

Solutions for Our Climate

Helen Burley,

International Media,

Reclaim Finance

Solutions for Our Climate (SFOC), Environment Centre NT, Japan Center for Sustainable Environment and Society (JACSES), Jubilee Australia Research Centre, Reclaim Finance, and Urgewald published a report on banks behind Australia’s dirtiest gas project—the Barossa gas project. The research, for the first time, uncovered how much private financial institutions have directly funded the gas project.

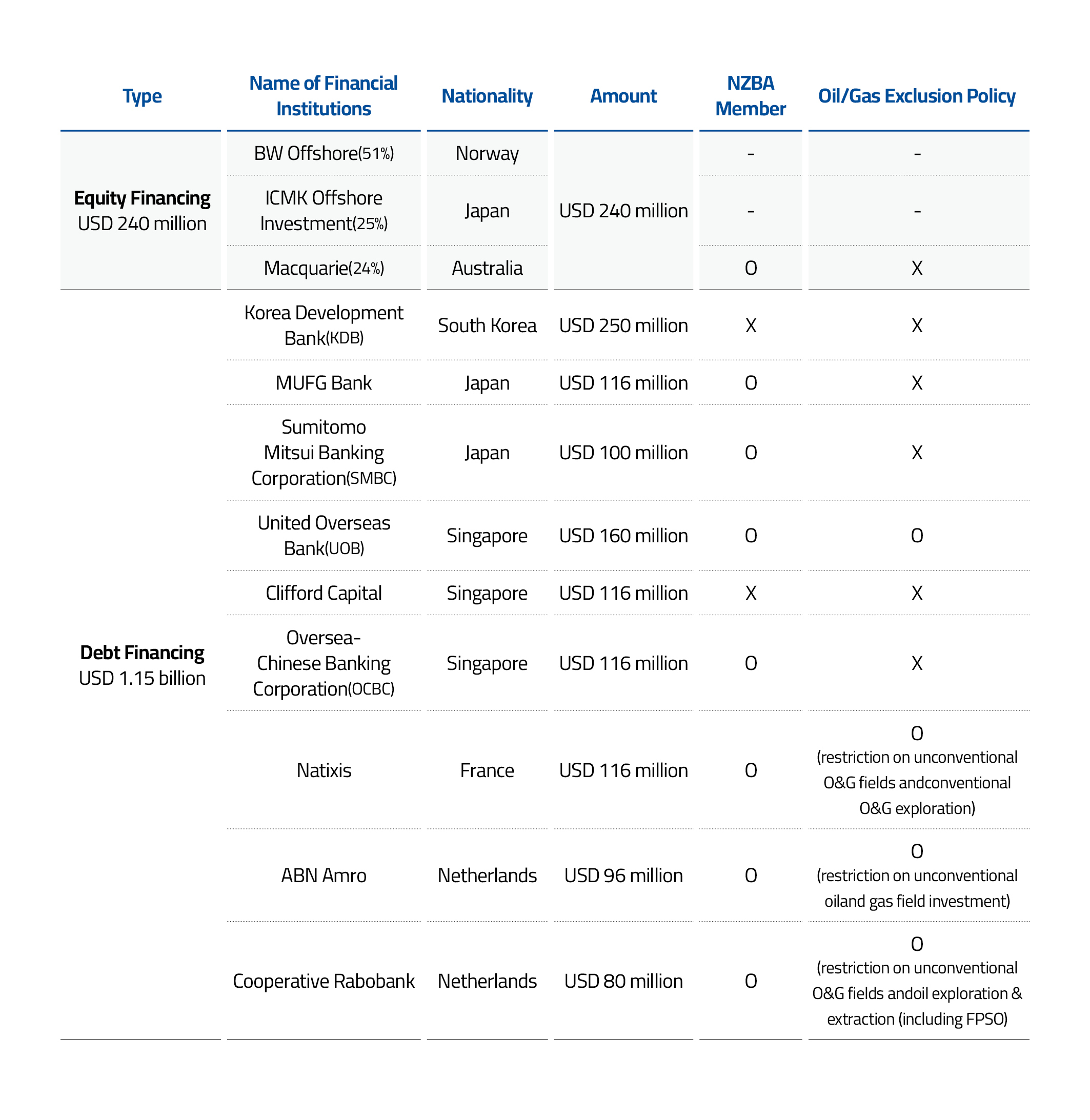

The report reveals nine banks that provided a total of US $1.15 billion in loans to build the Floating Production Storage and Offloading (FPSO) vessel, a ship that would process gas extracted from the Barossa gas field before transporting it to a nearby gas plant in Northern Australia.

The Barossa project is expected to release 13.5 million tons of CO2eq each year – around 3 percent of Australia’s annual carbon emissions. Even with the proposed carbon capture storage (CCS), it is projected to release similar amounts of emissions.

The banks financing the gas project include: Korea Development Bank (KDB)*, United Overseas Bank (UOB), Clifford Capital, MUFG Bank, Natixis, Oversea-Chinese Banking Corporation (OCBC), Sumitomo Mitsui Banking Corporation (SMBC), ABN Amro, and Cooperative Rabobank. In addition, Macquarie Bank served as a structuring bank, facilitating the entire financial transaction. (*Note: KDB is state-owned.)

All of the banks involved, except for KDB and Clifford Capital, are committed to achieving net-zero by 2050 with their lending and investment portfolios, under the UN-convened Net-Zero Banking Alliance (NZBA). To meet this climate target, the world must stop developing new oil and gas fields, according to the International Energy Agency.

The report follows a series of legal challenges against the Barossa gas project led by Indigenous communities. Last December, the Australian Court revoked the project drilling permit for inadequate consultation of Traditional Owners. In March, Traditional Owners lodged a human rights complaint against banks associated with the project.

The organizations behind the report urge financial institutions to withdraw their investments from the gas project. The banks are eligible for repayment from the project owners if major approvals and permits are not obtained, according to documents from KDB. The report also recommends that banks establish a policy to exclude financing for new oil and gas projects, including investments in FPSOs.

Dr. Luke Fletcher, Executive Director of Jubilee Australia Research Centre:

“Here in Australia, we are already seeing the effects of the climate crisis, with record-breaking bushfires and floods. Our research has found that the Barossa gasfield could be Australia’s dirtiest LNG operation. Fighting the climate crisis must begin with stopping new fossil fuel projects from going ahead. As the Australian government legislates its signature safeguard mechanism policy to combat emissions, financiers could be investing in a failed operation.”

Lucie Pinson, Executive Director of Reclaim Finance:

“The involvement of these banks in this polluting project highlights the utter meaningless of the net zero pledges they have made. The signatories to the Net Zero Banking Alliance (NZBA), which include the French bank Natixis, want to be seen as climate leaders, but their actions show that they are still supporting the development of extremely damaging fossil fuel projects, which will lock us into a high carbon future. This is classic greenwashing and it is high time Natixis and the other NZBA banks stop financing new fossil gas projects, including Barossa.”

Naish Gawen, Gas Campaigner at Environment Centre NT:

“Gas companies, banks, public financial institutions, and investors all need to reckon with the fact that you can't just rush ahead with fossil fuel projects on First Nations peoples’ land without even talking to them first, and without obtaining their consent. That is not acceptable conduct, and it will be opposed. If developed, Barossa would be the dirtiest offshore gas project in Australia. Not only is the project a polluting carbon bomb, it is opposed by Traditional Owners, and poses grave risks to marine life and Sea Country.”

Dongjae Oh, Oil and Gas Finance Researcher at Solutions for Our Climate (SFOC):

“The Barossa gas project is floundering. Between strengthened environmental regulation and growing public opposition against the project, the FPSO will become useless. The banks have a choice. They can drown along with the Barossa gas project and suffer financial, legal and reputational damages, or walk away now and display climate leadership.”

Yuki Tanabe, Program Director of the Japan Center for Sustainable Environment and Society (JACSES):

"MUFG Bank and SMBC have joined the Net Zero Banking Alliance (NZBA) and committed to make their portfolio net zero by 2050. Financing new gas development runs counter to this goal. The two Japanese banks have also adopted the Equator Principles which require them to ensure rights of indigenous peoples. Thus, the loan should be cancelled.”

Heffa Schücking, Director of Urgewald:

"It is madness to finance new fossil fuel projects at a time when the UN and the world’s climate scientists are warning us that CO2 emissions must be halved by 2030. By backing the Barossa project, these banks are unleashing a new carbon bomb we can’t afford."

Henrieke Butijn, Climate Campaigner & Researcher, BankTrack:

“Deciding to finance a project that has not secured free, prior and informed consent (FPIC) from all the indigenous people on the Tiwi Islands is outrageous. Almost all banks, including ABN Amro and Rabobank, are signatories to the Equator Principles and are thereby bound to ensure a proper environmental and human rights impact assessment and FPIC has been obtained. The only logical conclusion would have been to refuse to finance a climate-wrecking project run by companies with a poor track record on human rights and the environment. But they can still do the right thing by immediately terminating the loan contract.”

Read the report here.