Pulp Fiction: the dystopian reality of the origin of your paper

Sergio Baffoni, Environmental Paper Network, tel: +49 162 3812528 (CEST)

Sergio Baffoni, Environmental Paper Network, tel: +49 162 3812528 (CEST)

16 July 2024 – Today, the Environmental Paper Network International has launched a daunting report on Suzano, the world’s largest producer of eucalyptus pulp and one of the major paper producers in South America. The report exposes the devastating impact of Suzano’s operations on South America’s environment and local communities. Suzano is a major landholder, controlling 2.7 million hectares across seven Brazilian states and three crucial biomes.

Suzano’s sustainability statements are confronted with concrete cases of land grabbing, violent conflicts with leaders of indigenous communities, as well as the actual impact on water resources from eucalyptus plantations, the chemical poisoning of subsistence agriculture due to the use of pesticides putting in question whether this company should be eligible for green finance. The report, among other cases, describes that of Antônio Sapezeiro, a Quilombola leader who was arrested by military police after being attacked by a private guard dog. This case shows the confronting or criminalising nature of the company’s action towards community members trying to assert their rights.

“Despite Suzano portraying itself as fundamentally ‘green’, socially responsible, and ecologically sound, facts on the ground unveil a different picture.” explains Sergio Baffoni, campaigner at the Environmental Paper Network International, “Suzano’s history, its present, and its plans all reveal a company that places a heavy burden on local communities, forests, and the planet”

Nowadays, Suzano claims only to plant on previously degraded land. However, before they merged in Suzano’s paper conglomerate, its subsidiaries used to deforest the coastal forests to make space for pulpwood plantations. The pulp and cattle sectors work in a mutually supporting cycle, whereby ranchers often sell their land to the pulp and paper industry and use the profits to purchase new land at a forest frontier. While deforestation has increased, according to one study, Brazil’s total land under pasture has barely changed in the last 20 years. Cattle ranchers may be an instrument of deforestation, but it is often the pulp and paper industry which is the engine.

Suzano's Financiers

Between 2016-2023, Suzano received over USD 25 billion in credit from big financial institutions, including JPMorgan Chase, BNP Paribas, Rabobank, Mizuho and Bank of America. Blackrock is the biggest investor in Suzano with USD 488 million. Vanguard comes second with USD 278 million. Please see the Figure 1.

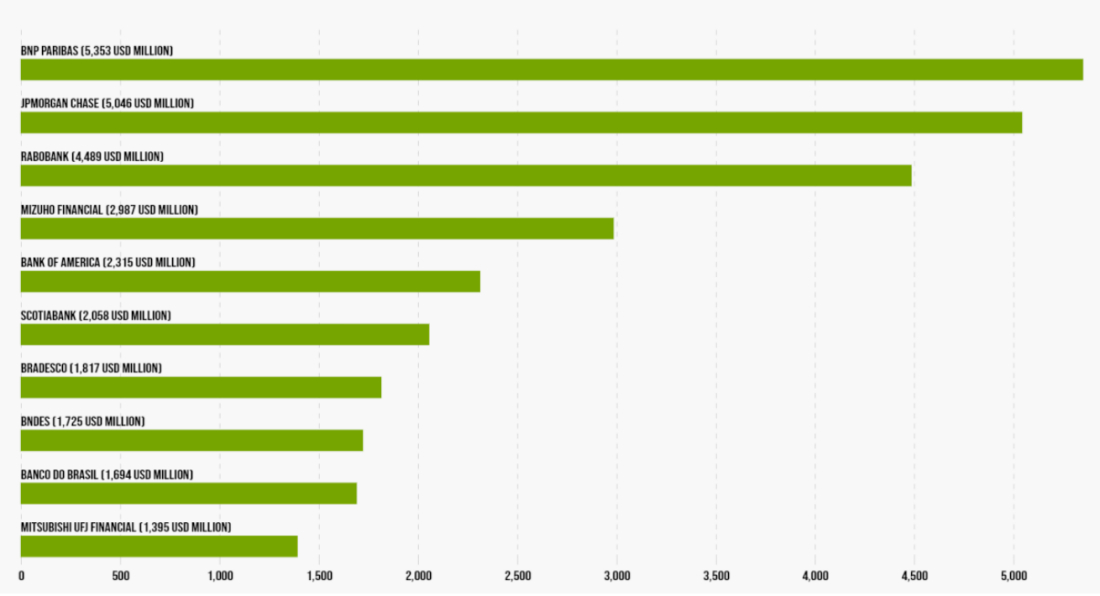

However, over the past five years, the creditors of Suzano have slightly changed. Please see Figure 2 for an overview of the 10 biggest creditors between 2019-2023. The World Bank and SMBC Group are now part of the 10 biggest creditors of Suzano.

No Deforestation, Green Finance’, they said?

Despite facing 295 possible and probable civil and environmental proceedings and the company’s impact on biodiversity, water, air, soil and the climate, Suzano receives billions of dollars in ‘green’ financing, constituting 39% of the company’s total debt. This has been possible partly because of Suzano’s success in achieving its environmental, social, and governance (ESG) performance accolades. In March 2024, Suzano received a sustainability-linked loan of USD $780 million, although the details and objectives of this loan remain murky. The loan was arranged and financed by private banks (details obtained by Refinitiv and shared by Profundo): BankAmerica Corp, Rabobank, Export Development Canada, HSBC, Industrial & Commercial Bank of China Ltd, KfW IPEX-Bank GmbH, Mizuho Bank Ltd, MUFG Bank Ltd, Sumitomo Mitsui Banking Corp, Credit Agricole Corporate & Investment Bank (Administration Agent). Although Suzano has a webpage dedicated to ESG indicators, it is unclear which indicators are included in the Sustainability Linked Loan. The Norton Rose Fulbright (the lawyers advising Suzano on the loan) press release only mentions environmental performance indicators. Social, human rights and governance indicators are likely missing from the loan.

The company has also attracted billions in public development investments. In December 2022, after obtaining USD 430 million from the Brazilian development bank BNDES, the private arm of the World Bank (IFC) approved its first-ever loan to Suzano. Together with Brazilian and international organisations, EPN opposed this financing since it provided little environmental, social or governance benefit, but IFC chose to ignore our concerns. We feared that this would open up financing from other development banks, and this became a reality when FMO announced that it was joining IFC in the loan.

EPN together with BankTrack and other civil society organisations informed financial institutions on numerous occasions over the past decade and published materials on Suzano and the pulp industry in Brazil. By choosing to continue to support Suzano, both the private and public banks are now willingly profiting from the severe social and environmental impacts of the company. Moreover, public development funds are being given to a company that has not yet proven to bring development to a region.

What must happen?

EPN International has laid out a comprehensive set of demands to the Brazilian pulp and paper industry, their investors and business partners in Scorching the earth. The impacts of pulp and paper expansion in the Três Lagoas region, Brazil. The paper presents specific measures to respect the traditional land rights of Indigenous and other local communities, mitigate environmental impacts on forests, climate and water table, and embrace transparency. Suzano should implement these changes in full. To ensure this happens, public and private financial institutions should investigate and engage with Suzano around these demands and suspend financial services to the company in the meantime.

The report is available in English and in Portuguese and a summary is available in Dutch