South African banks still score poorly on climate

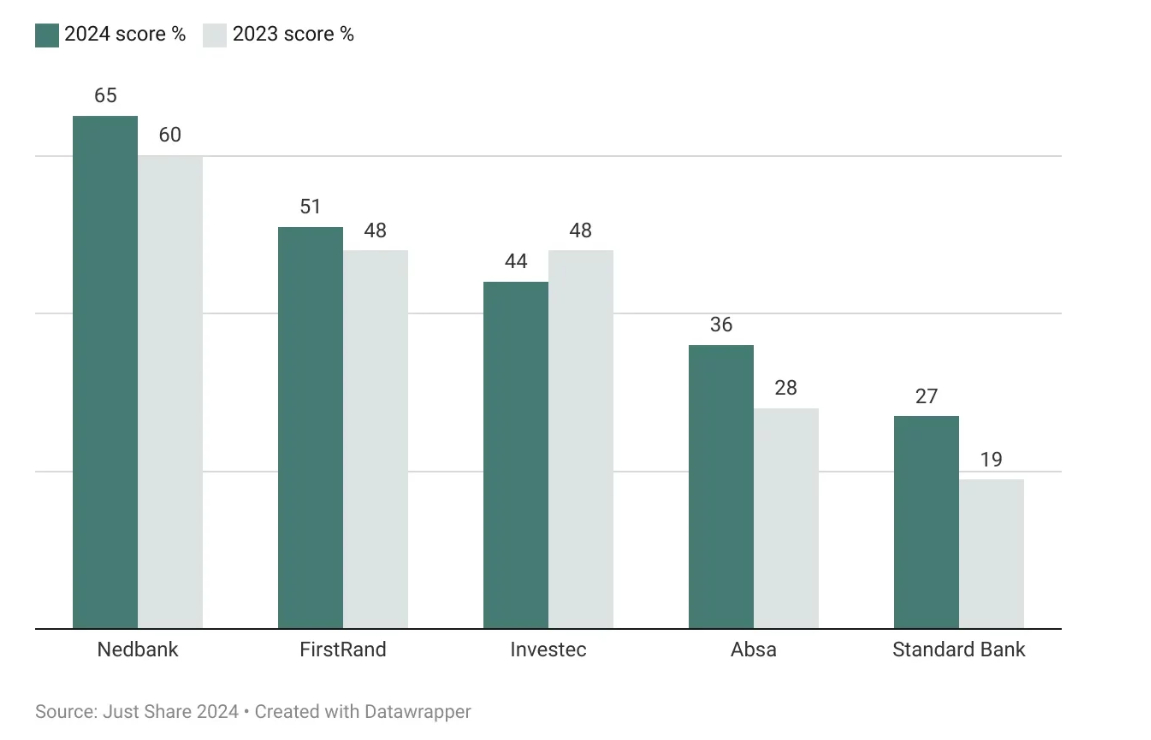

South Africa’s biggest banks are still not progressing quickly enough on climate action. In Just Share’s new report – How cool is your bank 2024 – even the highest-scoring bank, Nedbank, achieved only 65%.

The low scores across all five banks suggest that none is tackling climate risk robustly when assessed against the goals of the Paris Agreement. The incremental signs of progress are vastly insufficient, given the urgency and extent of what climate science requires.

This is the second year that Just Share has analysed the most recent climate-related disclosures, policies and practices of South Africa’s five largest banks: Absa, FirstRand, Investec, Nedbank, and Standard Bank.

The report evaluates the extent to which these banks disclose, manage and integrate climate risks and opportunities into their financial decision-making, and the extent to which their lending and investment activities support their stated commitment to the goals of the Paris Agreement.

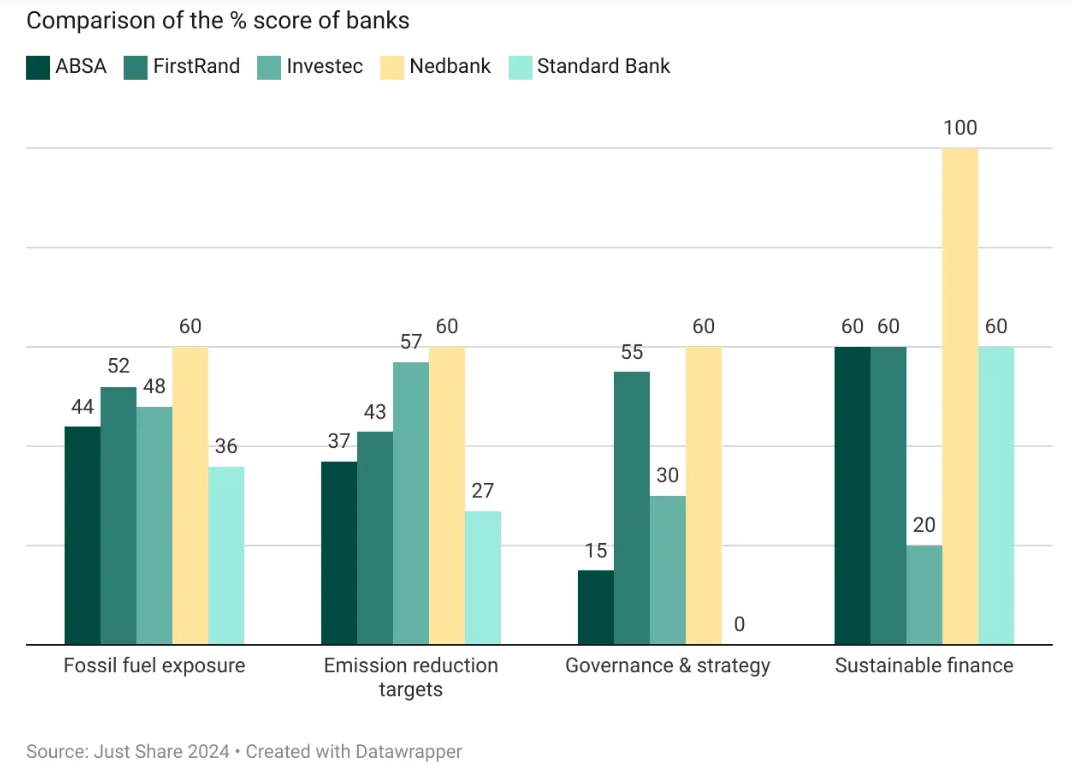

The assessment was conducted across four categories: fossil fuel exposure, emission reduction targets, governance and strategy, and sustainable finance, comprising 20 indicators in total with a maximum score of 85 points.

Each section looks at a key area of the banks’ disclosures: (1) fossil fuel-related policies and exposure, and renewable energy exposure; (2) targets and strategies for reducing exposure to high-emitting sectors; (3) climate-related expertise and conflicts on the board, and high-level strategic approaches to climate; and (4) frameworks, disclosures and targets for increasing sustainable finance.

Together the sections depict how effectively the banks are integrating climate-related risks and opportunities across their businesses:

Key findings:

- The gap between the leaders and the laggards has decreased this year, due primarily to the laggards making some improvements while leaders have largely stalled in their progress.

- Finance flows still fall far short of the levels needed to meet climate goals.

- Standard Bank is the lowest-scoring bank for the second year in a row, achieving only 27% and again scoring 0 out of 20 points in the governance and strategy category. Nevertheless, as with all the banks except for Investec, Standard Bank’s score improved this year. It has introduced a target for reducing its exposure to fossil fuels, improved the share of renewable energy in its overall lending, and has finally begun disclosing its exposure to fossil fuels.

- FirstRand is the only bank to decrease its fossil fuel exposure in the year of assessment.

- Absa introduced a target to reduce exposure to fossil fuels, improving its score.

- Investec is the only bank with a lower score than last year. This is due to its increased exposure to fossil fuels – a reversal from its decreased fossil fuel exposure in 2023.

- Only Absa and Nedbank have disclosed partial strategies for meeting their emission reduction targets. The failure to define decarbonisation pathways with clear milestones and targets undermines the banks’ ability to deliver on their net zero commitments.

- No bank has introduced any new exclusions or meaningful limitations on their financing for fossil fuels.

- All the banks have increased the share of renewable energy in their overall energy financing.

- While disclosure of scope 3 financed emissions is gradually improving, none of the banks has fully disclosed its scope 3 financed emissions. Incomplete disclosure of financed emissions limits the ability of stakeholders to evaluate the emission reduction progress of the banks

Karishma Bhoolia, senior climate risk analyst at Just Share, points out that “through their lending, investment and underwriting activities, banks can either exacerbate the climate emergency or play a constructive role in urgently reducing greenhouse gas emissions and financing the transition to a low-carbon, inclusive economy. However, the lack of progress made since our 2023 assessment, especially by the leaders, reveals that this is not happening either at the pace or scale required to limit global temperature rise to 1.5°C above pre-industrial levels – or even to meet South Africa’s own global commitments under the Paris Agreement”.

Read the full report. Reposted from the original news story here.