The 2023 Global Coal Exit List: Failing the Phase-Out

Heffa Schuecking,

Director,

Urgewald,

+49-160-96761436

Dr. Ognyan Seizov,

International Communications Director,

Urgewald

+49-30-863-2922-61

Heffa Schuecking,

Director,

Urgewald,

+49-160-96761436

Dr. Ognyan Seizov,

International Communications Director,

Urgewald

+49-30-863-2922-61

Four weeks after the UN’s Climate Ambition Summit in New York, Urgewald and more than 40 NGO partners released the 2023 “Global Coal Exit List” (GCEL). The GCEL provides in-depth information on over 1,400 companies operating along the thermal coal value chain and is the world’s most comprehensive public database on the industry.

“The overall picture that our data delivers is bleak,” says Heffa Schuecking, director of Urgewald. “Out of the 1,433 companies on the GCEL, only 71 companies have announced coal exit dates. Meanwhile, 577 companies are still developing new coal assets. Without forceful action by governments, the finance industry and regulators, the chapter of coal won’t be closed.”

Expanding the Problem

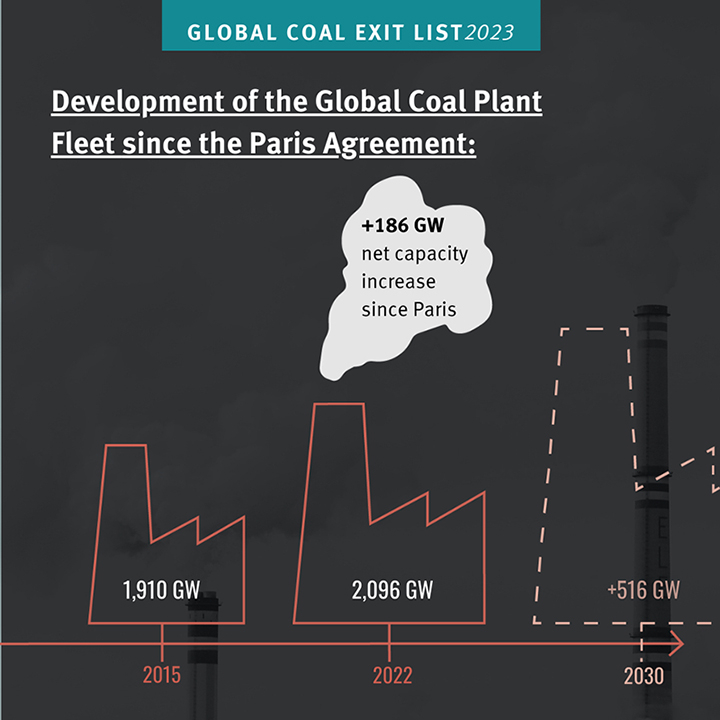

Despite coal plant closures in some parts of the world, the global coal plant fleet has seen a net growth of 186 GW since the Paris Agreement was signed. To put this into perspective: 186 GW are more than the operating coal plant fleets of Germany, Japan, South Korea and Indonesia combined.

According to the 2023 GCEL, companies are still planning to develop an additional 516 GW of new coal-fired capacity. If built, these projects would increase the world’s current installed coal-fired capacity by 25%. Two-thirds of this new capacity is planned in China, which has been ramping up its coal power plans since 2022, when drought diminished the country’s hydropower output and record-breaking heat waves caused electricity demand to skyrocket. So, it comes as no surprise that 8 of the world’s top 10 coal plant developers are state-owned Chinese power corporations. What is surprising is that 96 US investors, led by BlackRock and Vanguard, account for 26% of institutional investments in China’s 8 top coal power developers. With US$ 1.68 billion, BlackRock is the world’s largest institutional investor in these companies, while Vanguard takes 4th place with US$ 909 million.

In the rest of the world, plans for new coal-fired capacity have seen a significant drop. Out of the 39 countries where new coal power plants are still in the pipeline, the largest capacity additions are planned in India (72 GW), Indonesia (21 GW), Vietnam (14 GW), Russia (12 GW) and Bangladesh (10 GW).

Coal Mining Expansion

With over 7.2 billion tons, the world’s thermal coal production reached an alltime high in 2022.3 And new coal mines are still on the horizon in 31 countries. All in all, companies on the GCEL are planning to develop new thermal coal mining projects with a total capacity of 2.5 billion tons per year, an amount equal to over 35% of the world’s current production.

The number one hotspot of the coal mining boom is India where coal production already reached a historic high of 893 million tons last year. According to the goal set by India’s Ministry of Coal and Mines, the country’s annual coal production would rise to 1.5 billion tons by 2030.4 To fulfill this plan, the government has auctioned off 92 new coal mining concessions since 2020; hundreds more are in the pipeline. “What is being auctioned off here are the traditional homelands of hundreds of thousands of India’s tribal people and forest areas that are incredibly rich in biodiversity and play a key role in maintaining water cycles. It’s absurd to pretend this immense destruction is in the national interest,” says Joe Athialy, Director of the Centre for Financial Accountability in Delhi.

The world’s top 3 coal mine developers are Coal India with projects totaling 591 million tons of new coal production per year, China Energy Investment with 169 million tons and the Adani Group with 94 million tons. While the first two companies are state-owned, the Adani Group belongs to the billionaire Gautam Adani whose business has profited time and again from his close ties to the Modi government. Today, Adani is the world’s largest private coal mine developer. The conglomerate owns coal mines in 3 countries, is a major trader and transporter of coal, operates a 16 GW coal plant fleet (with another 10 GW in the pipeline), and plans to build a huge US$ 4 billion coal-to- plastics facility in India. While one of the Adani Group’s 9 listed subsidiaries – Adani Green Energy – develops solar projects, the Group’s renewable investments are dwarfed by its enormous coal portfolio.

You can read the whole media briefing here.