Time to end metallurgical coal expansion

Heffa Schuecking | Director, Urgewald heffa@urgewald.org

Lia Wagner | Head of Met Coal Research, Urgewald lia.wagner@urgewald.org

Dr. Ognyan Seizov | International Communications Director, Urgewald ognyan.seizov@urgewald.org, +49 30 863 2922 61

Heffa Schuecking | Director, Urgewald heffa@urgewald.org

Lia Wagner | Head of Met Coal Research, Urgewald lia.wagner@urgewald.org

Dr. Ognyan Seizov | International Communications Director, Urgewald ognyan.seizov@urgewald.org, +49 30 863 2922 61

Today, Urgewald and 10 NGO partners including BankTrack, published the first Metallurgical Coal Exit List (MCEL), a public database of coal companies which are expanding their met coal mining activities. “Hundreds of financial institutions are already using our Global Coal Exit List (GCEL) to restrict their financial flows to the thermal coal sector. The MCEL is a new sister database that focuses exclusively on metallurgical coal and highlights which companies are planning new met coal mines or extensions. Financial institutions need to wake up and stop bankrolling the reckless expansion of this industry,” says Heffa Schuecking, Director of Urgewald.

The MCEL features 160 companies worldwide and can be downloaded at: https://coalexit.org/mcel

From hard-to-abate to fast-to-abate

This year the Paris Agreement will celebrate its 10th anniversary, but the 1.5° C target has never seemed further out of reach. Current climate protection efforts are failing and real progress must include sectors often deemed difficult to decarbonize — like the steel industry. Due to its reliance on coal, the iron and steel sector is responsible for 11% of global CO2 emissions. (1)

Coal used by the steel industry is referred to as metallurgical (met) coal and includes coking coal, which is needed to produce coke, a key ingredient in blast furnace steel production. While steel was long considered to be a hard-to-abate sector, new technologies now enable the shift to coal-free steel production methods. According to the think-tank Agora Industry, a phase-out of coal in the steel sector by the early 2040s is technically feasible. (2) “Recent advancements in green steel production give us the chance to transform steel from a hard-to-abate industry into a fast-to-abate industry and end its dependence on coal. New met coal mines are harmful for our climate and endanger the Paris goals,” says Schuecking.

According to the International Energy Agency (IEA), existing production sources can cover the demand for met coal through 2050. (3) Even the Critical Raw Material Alliance acknowledges that global met coal production already surpasses demand by 37%. (4)

The heavyweights of met coal expansion

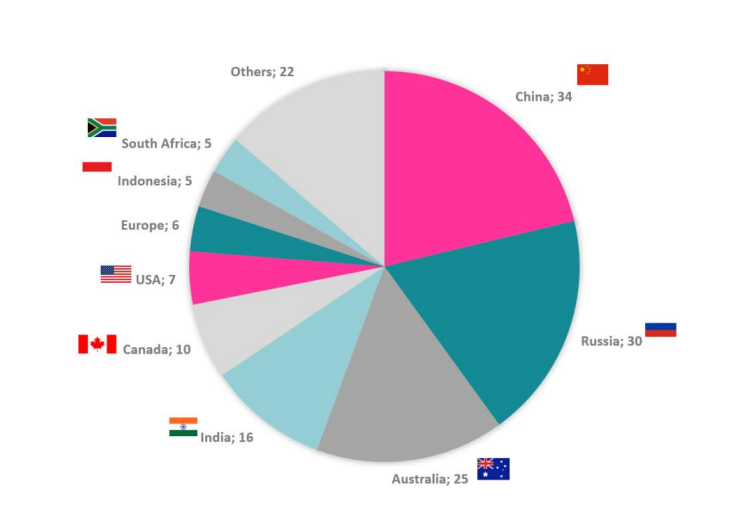

Many of the largest met coal miners are, however, still planning to expand their production. All in all, MCEL identifies 160 mining companies which are pursuing 252 met coal expansion projects in 18 countries. The planned production from new and extended met coal mines would equal 551 million metric tons per year and would increase the world’s current met coal production by 50%.

Our data reveals that most met coal expansion projects—and the companies behind them—are concentrated in Australia, Russia and China. Australia is the world’s largest met coal exporter, and India and Japan are among the primary destinations of its exports. (5) Japan’s largest steelmaker, Nippon Steel, holds a strategic stake in the Australian Bulga coal mine to ensure a steady supply of its raw material. (6) Following suit, India's JSW Steel recently announced its purchase of a stake in Illawara Metallurgical Coal’s Australian coking coal mines. (7) The following graphic provides an overview of the regional distribution of companies which are still expanding their met coal operations.

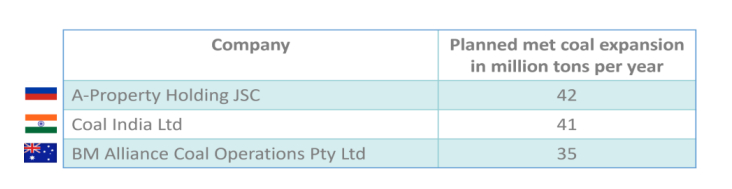

On the company level, the top driver of metallurgical coal expansion is the investment firm A-Property. Owned by Russian billionaire Albert Avdolyan and his business partner Sergey Adonyev, A-Property is spearheading two massive met coal mine projects: the Elginsky and Sugodinsk-Ogodzhinsky expansions in eastern Russia. One could assume that the Russian invasion of Ukraine marked a turning point for the Russian coal industry. In fact, one of A-Property's main mining subsidiaries, ElgaUgol, is currently on the U.S. sanctions list. (8) Nevertheless, the company continues to build port facilities for the export of Elga coking coal. The firm's second major mining entity appears to be unaffected by U.S. sanctions, although both companies can be traced back to Albert Avdolyan.

Coal India is the world’s second-largest met coal developer and is coincidentally also the second-largest met coal producer worldwide. Next in line is BM Alliance Coal Operations (BMA), a joint venture between BHP and Mitsubishi, which plans to extend the life of its Peak Downs mine in Australia by 93 years. If approved, the mine would continue operating until 2116. As Harriet Kater, Climate Lead at the Australasian Centre for Corporate Responsibility, fittingly asks, “What part of net zero by 2050 does BMA not understand?". (9)

Met coal – Last resort for an embattled coal industry

Last year, the world’s biggest publicly traded coal miner, Glencore, expanded its coal production by 20% by buying the met coal segment of the Canadian company Teck Resources. (10) According to Lia Wagner, Head of Met Coal Research at Urgewald, Glencore’s move is part of a wider strategic shift: “Many thermal coal producers seem to be trying to polish their dirty public image and retain access to financing by adding more met coal to their portfolios.”

A prime example is the Australian company Whitehaven Coal, whose thermal coal production accounted for 95% of revenues last year. As an increasing number of insurers are shunning thermal coal companies, Whitehaven struggled to find insurance for its coal operations. Earlier this year, however, the company acquired the Blackwater and Daunia metallurgical coal mines from BHP and met coal now accounts for over half of Whitehaven’s total coal revenue. According to a Whitehaven spokesperson, this portfolio diversification played a key role in securing insurance coverage for the company. (11) Unjustifiably so – met coal can be up to three times more polluting than thermal coal. (12)

The UK government recently had to acknowledge the emissions intensity of metallurgical coal mines, when its decision to approve a new met coal mine was overturned by the UK High Court in September 2024. The mine, owned by West Cumbria Mining, had been promoted as the world's first “net-zero coal mine.” A ridiculous claim as burning the extracted coal for steel production would have unleashed carbon emissions exceeding 220 million tons – an amount equal to over half of the UK's total emissions in 2022. (13) Meanwhile, one of the UK’s last two blast furnaces for steel production was shut down this year, highlighting a significant industry shift away from coal. (14)

The victory against West Cumbria Mining was a major success for the environmental organizations South Lakes Action on Climate Change (SLACC) and Friends of the Earth UK. It established a groundbreaking legal precedent by recognizing that the emissions from burning coal must be factored into the calculation of a met coal mine’s total emissions.

Met coal – The blind spot in financial institutions’ coal policies

The NGO Reclaim Finance regularly analyzes the coal policies of 386 major financial institutions. (15) According to their analysis, 183 financial institutions have adopted policies on thermal coal, but only 16 financial institutions have policies covering metallurgical coal. Out of these 16 financial institutions, 11 are banks, 4 are asset managers and one is an insurer. Three of these financial institutions are from Australia and the rest are headquartered in Europe. While the scope of most met coal policies is limited to direct project finance, research by Reclaim Finance indicates that project-level financing represents only a tiny proportion of total financing received by companies with met coal expansion plans. (16) The Swiss insurer Zurich has adopted one of the best met coal policies which excludes new metallurgical coal mines as well as the companies developing them. (17)

“Metallurgical coal represents almost 13% of total coal production and financial institutions need to finally address this gigantic blind spot in their coal policies,” warns Wagner.

“There is no reason, scientific or otherwise, to deem metallurgical coal less risky or more desirable than thermal coal. From a climate perspective, coal is coal and must be phased out regardless of its end use. The technologies to decarbonize steel production are available and are already being deployed by first-movers in the industry. Financial institutions must support the transition to coal-free steel instead of backing companies that are developing new dirty met coal mines,” says Cynthia Rocamora, Private Finance Campaigner at Reclaim Finance.

About MCEL

The Metallurgical Coal Exit List (MCEL) is the world’s most comprehensive public database of met coal developers. It was designed to bring transparency to a sector that is often overlooked in the decarbonization process. As a sister database to the Global Coal Exit List (GCEL), MCEL enables financial institutions to better understand their exposure to this high-emissions industry and to develop new met coal exclusion policies. To ensure that our data creates lasting added value, MCEL will be updated annually.

The Metallurgical Coal Exit List is published by Urgewald and Reclaim Finance, BankTrack, SteelWatch, Global Energy Monitor (GEM), Coal Action Network, Coal-free Finland, Nordic Center for Sustainable Finance, Ecodefense, Rainforest Action Network and The Sunrise Project.

Sources

- https://static1.squarespace.com/static/5877e86f9de4bb8bce72105c/t/624ebc5e1f5e2f3078c53a07/1 649327229553/Steel+climate+impact-benchmarking+report+7April2022.pdf

- https://www.agora-industry.org/data-tools/global-steel-transformation-tracker#c425

- https://iea.blob.core.windows.net/assets/deebef5d-0c34-4539-9d0c-10b13d840027/NetZeroby2050- ARoadmapfortheGlobalEnergySector_CORR.pdf

- https://www.crmalliance.eu/coking-coal

- https://gmk.center/en/news/australia-lowers-forecast-for-coking-coal-exports-for-fy2024-2025/

- https://www.glencore.com.au/operations-and-projects/coal/current-operations/bulga-coal

- https://www.reuters.com/markets/deals/indias-jsw-steel-buy-120-mln-stake-australian-firm-expand-coal-reserves-2024-08-12/

- https://www.cov.com/en/news-and-insights/insights/2024/06/us-government-issues-new-us-sanctions-and-export-controls-targeting-russia-and-belarus-for-continued-aggression-against-ukraine-update-on-european-sanctions-developments

- https://www.accr.org.au/news/bhp-%E2%80%98delusional%E2%80%99-seeks-coal-mine-extension-to-2116/

- https://www.teck.com/media/2023-Annual-Report.pdf

- https://archive.md/RUdsV#selection-1659.0-1659.107

- https://www.woodmac.com/news/opinion/putting-coal-mine-emissions-under-the-microscope/

- https://www.theguardian.com/environment/2024/sep/13/high-court-blocks-cumbria-plan-for-first-new-uk-coalmine-in-30-years

- https://www.bbc.com/news/articles/c70zxjldqnxo

- https://coalpolicytracker.org

- https://reclaimfinance.org/site/wp-content/uploads/2023/11/Reclaim_Finance_Metallurgical_Coal_November_2023.pdf

- https://reclaimfinance.org/site/en/2024/12/10/insurance-scorecard-2024-cut-emissions-today-toinsure-tomorrow/