Active

This profile is actively maintained

Active

This profile is actively maintained| Website | http://www.wellsfargo.com/ |

| Headquarters |

420 Montgomery Street

CA 94104 San Francisco

United States

|

| CEO/chair |

Charles W. Scharf CEO and President |

| Supervisor | |

| Ownership |

listed on NYSE

Wells Fargo's complete shareholder structure can be accessed here. |

Wells Fargo is a US financial services company which was founded in 1852. The Bank is headquartered in San Francisco. Wells Fargo serves more than 70 million customers and has offices in 32 countries. The financial institution provides banking, investment, mortgage products and services, and consumer and commercial finance.

Wells Fargo's most important sustainability commitments can be found at the website sections listed below.

Links

Wells Fargo is linked to a number of companies and projects that BankTrack considers controversial (so called Dodgy Deals), e.g. as a current or past financier or through an expression of interest. The profiles below provide more details on the nature of Wells Fargo's link to these deals.

Wells Fargo does not operate a complaints channel for individuals and communities that may be adversely affected by its finance.

Customers, however, can make a complaint via the bank's customer services. Stakeholders may raise complaints via the OECD National Contact Points (see OECD Watch guidance).

This page evaluates Wells Fargo's responses to instances of alleged human rights violations linked to its finance, raised by civil society organisations. It is not intended to be exhaustive, but covers selected impacts raised by BankTrack and other civil society partners since 2016. For the full scoring methodology, see here. For more information about BankTrack's evaluation of bank responses to human rights impacts, see the 2021 report "Actions speak louder: assessing bank responses to human rights violations".

The bank publicly responded stating that "as a general rule, Wells Fargo does not disclose details regarding specific relationships".

Following the bank's response: The score remains unchanged.

The bank provided no detail on whether it engaged with its client or took approriate action.

Following the bank's response: The score remains unchanged.

No information available on whether the bank monitored progress.

Following the bank's response: The score remains unchanged.

Banks and Climate

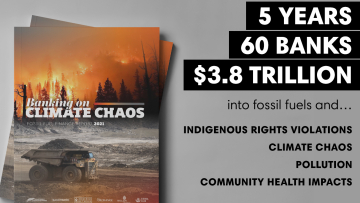

The 2024 Banking on Climate Chaos report showed that Wells Fargo provided US$ 296.247 Billion in financing to the fossil fuel industry between 2016 and 2023. In 2023 only, Wells Fargo provided US$ 11.752 Billion for oil, gas and coal companies expanding fossil fuels. Find further details on Wells Fargo fossil fuel portfolio and how it compares to other large banks globally on Fossil Banks No Thanks and in the Banking on Climate Chaos report.

Partner organisation Reclaim Finance tracks the coal, oil and gas policies of financial institutions, including banks, in their Coal Policy Tool (CPT) and the Oil and Gas Policy Tracker (OGPT). BankTrack works closely with Reclaim Finance and endorses their policy assesments. Find further details on their assessment of Wells Fargo’s fossil fuel policy below.

Banks and Human Rights

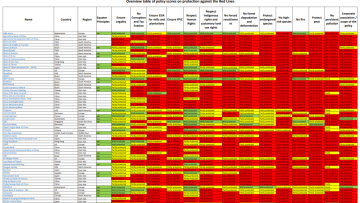

BankTrack assessed Wells Fargo in its 2024 Global Human Rights Benchmark, where it achieved 5.5 points out of 15 and was ranked as a follower.

The bank scored 0.5 out of 3 points on the new “specific rights indicators”, which assess how banks address human rights defenders, Indigenous Peoples’ right to Free, Prior and Informed Consent and environmental rights in their policies and practices.

In addition, Wells Fargo scored 0 out of 3 on how it responds to alleged human rights violations linked to its finance, which were raised by civil society organisations. More information is detailed in the “Accountability” section of this profile.

The table below shows BankTrack's assessment of how Wells Fargo has implemented the UN Guiding Principles on Business and Human Rights. Please click on 'expand all details' and 'explanation' for further information on the methodology.

Our policy assessments are always a work in progress. We very much welcome any feedback, especially from banks included in the assessments. Please get in touch at humanrights@banktrack.org.

Global Human Rights Benchmark 2022

Global Human Rights Benchmark 2024

Tracking the Net Zero Banking Alliance

Wells Fargo left the Net Zero Banking Alliance (NZBA) on 20 December 2024. Before that, as a NZBA member it had committed to reduce its financed emissions to net zero by 2050; within 18 months of joining the alliance set interim targets for 2030 (or sooner) for high emission priority sectors, and within 36 months set further sector targets; set new intermediary targets every 5 years from 2030 onwards; annually publish data on emissions and progress against a transition strategy including climate-related sectoral policies; and take a robust approach to the role of offsets in transition plans. BankTrack will keep track of Goldman Sachs and other ex-NZBA member banks' climate action in a specific section of the NZBA tracker.

Banks and Steel

According to a report by Reclaim Finance, between 2016 and June 2023, Wells Fargo provided $5.9 billion in finance to the fossil-steel industry, making it the 23rd largest financier worldwide. Find further details on Wells Fargo's steel financing and how it compares to other large banks globally in the report.