Banking on Nippon Steel is a high risk bet on climate chaos

While Nippon Steel claims to be a global leader in the fossil steel sector, their insufficient climate plans and track record were publicly challenged by activists and investors at its Annual General Meeting (AGM) today. Bank financiers of Nippon Steel, like Mizuho, Goldman Sachs, and SMBC, should be concerned about the mounting evidence that Nippon has no intention of phasing coal out of steelmaking, committing instead to climate chaos.

Nippon Steel is the fourth-largest fossil steel producer in the world, with its home base in Japan. Its operations extend far beyond Japan, with subsidiaries and stakes in mining companies across America, Europe and South and Southeast Asia. It’s the largest fossil steel producer in Japan, and known for its role in blocking climate action through its focus on coal-based steelmaking and its resistance to transitioning to renewable energy.

As the AGM takes place with climate activists in attendance, shareholders have issued proposals demanding the company improve its decarbonisation strategies and disclosure on climate lobbying. The Australasian Centre for Corporate Responsibility (ACCR), Corporate Action Japan (CAJ) and Legal and & General Investment Management (LGIM) have co-filed three proposals demanding the company protect the long-term interests of shareholders. Financiers of Nippon should take note of the demands, and perceived risk from investors, as it may translate into tangible financial risks for their lending to the company.

Nippon Steels coal addiction is threatening its already weak targets

Ending the use of coal in steelmaking is essential for the world to meet the Paris Agreement, thus saving millions of lives from climate chaos. But as a recent report from SteelWatch points out, Nippon Steel is doubling down on burning coal, well beyond what our carbon budget can handle.

Currently, Nippon Steel’s climate plans aim to reduce absolute CO2 emissions by >30% by 2030, and achieve carbon neutrality by 2050. These targets are insufficient because they are set against a 2013 baseline, which, in Japan, was the year with a record high recorded emissions. Additionally, Nippon has set these targets in alignment with Japan's weak national climate policies, which are often criticised for their failure to meet the Paris Agreement’s goals.

Additionally, Nippon Steel takes a laid back approach to its subsidiaries' climate goal setting. In both the 2030 and 2050 goals they have set, these do not cover Nippon Steel Group but only Nippon Steel Corporation ‘the Company’- only covering its operations in Japan and not overseas. This remains concerning as their overseas assets are expected to grow and exponentially contribute to the company’s production expansion capacities. Nippon’s failure to report emissions of their increased footprint allows them to avoid responsibility, as they are offshoring greenhouse gas (GHG) emissions from Japan to other countries- a tactful evasion of taking initiative to align with a 1.5 global scenario.

Beyond its climate plans on paper, Nippon Steel's recent investments also demonstrate a commitment to coal over a safe climate, on which all life on Earth depends for present and future generations.

It is increasing its investment in coal mining in Australia and Canada and acquiring coal-dependent steel companies overseas, while simultaneously keeping its coal-powered blast furnaces operational. Nippon Steel’s coal addiction demonstrates its lack of commitment to the Paris Agreement’s 1.5 degrees scenario - a lifeline for millions.

Rather than phase out coal and switch to fossil free methods of steel making, Nippon is only slashing some of its emissions by decreasing their output in Japan. Due to declining demand for steel in Japan and Nippon’s desire to expand production, Nippon Steel is acquiring companies overseas that are coal dependent and is looking to extend the lifetime of its blast furnaces, rather than shifting to the use of electric arc furnaces, which can recycle steel and do not rely on coal.

Nippon’s pursuit of ‘breakthrough technologies’ to achieve their emissions' reduction goal by 2050 are unproven, expensive, and risk locking in fossil steel assets longer than we can afford. In their Carbon Neutral Vision 2050 Nippon aims to rely on unproven technologies including Carbon Capture and Storage (CCUS) and hydrogen injection into the blast furnaces making their efforts insufficient in accordance with the 1.5 degree goal. These efforts remain reliant on the proper development of required technologies, which are so far not forthcoming. The COURSE 50 and Super COURSE 50 (Hydrogen Injection Technologies into blast furnaces) relative to the Paris Agreement prove ineffective as carbon reduction technologies and with acquisitions and ambitious expansion plans underway for Nippon Steel, a failure to curb emissions grows increasingly in threat to the environment.

The banks who must act to stop Nippon Steel’s coal expansion

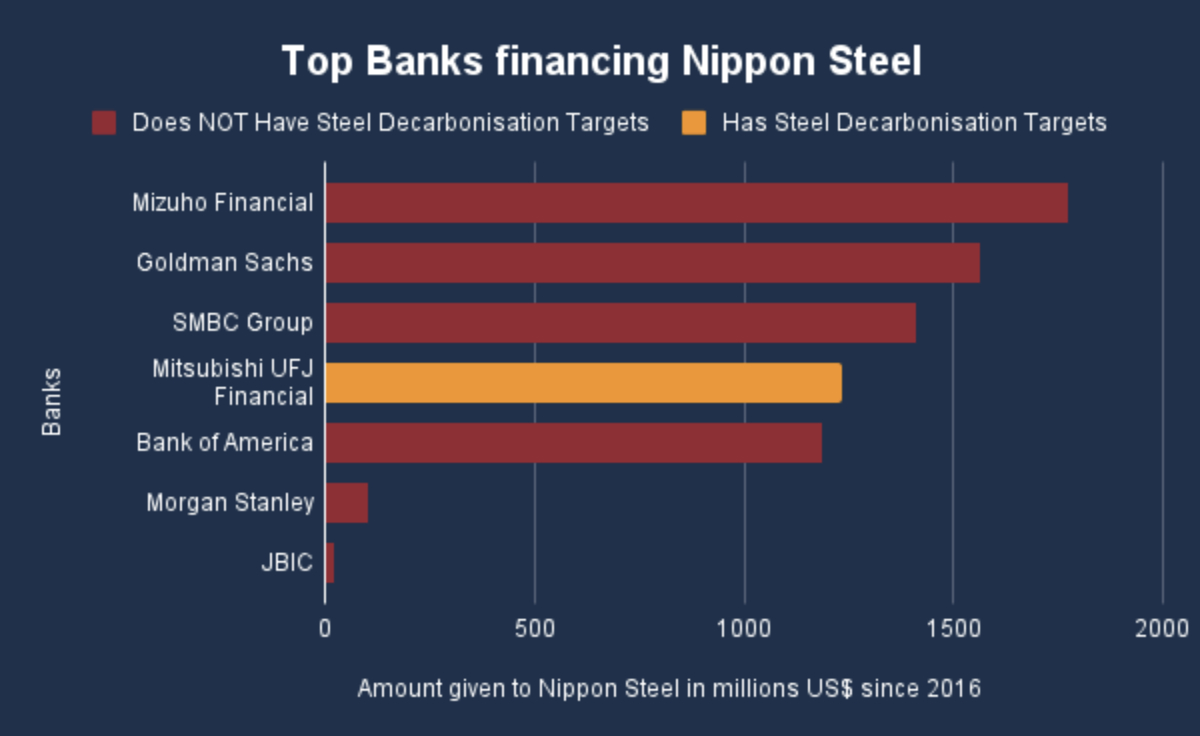

Out of Nippon Steel’s top lenders, the majority have failed to make public commitments to steel decarbonisation, including Mizuho Financial Group, which is the leading lender of Nippon Steel. If these banks are to lead in decarbonisation, they must adopt an engagement and escalation strategy for Nippon Steel to ensure it does not expand its coal-based steel production.

What banks financing Nippon Steel must do

In order for Nippon Steel to align to the Paris Agreement climate goals and meet its ambitious goal of achieving carbon neutrality by 2050 and meet climate targets for steel, banks should:

- Cease all investment in blast furnaces, meaning not extending lifespans by relining of old blast furnaces and disengaging in any acquisition and building of new ones by Nippon Steel.

- In any financing provided for subsidiaries, banks should perform due diligence in accordance with global climate targets to ensure that Nippon Steel has under its policies covered scope 3 emissions and is working to reduce them overtime.

- Lastly, banks must ensure that Nippon Steel provides a definite and precise roadmap for reducing cumulative emissions, with clear 2025 and 2030 Paris-aligned targets, and that they strengthen their targets in alignment with the 1.5c trajectory across all subsidiaries.