Challenging banks on their Dodgy Deals this AGM season

This year’s Annual General Meeting season saw pressure on banks ramped up like no other year. Few major banks left their AGMs unscathed by disruption, with activist shareholders and civil society putting environmental and human rights issues at the top of the agenda.

At BankTrack we joined a coalition of shareholders, civil society groups and frontline communities to ensure banks could not ignore the impacts of their dodgiest clients.

For example, we interrogated European banks Barclays, HSBC and Santander on their corporate financing for companies involved in fracking in Argentina’s Vaca Muerta Shale Basin, and also asked questions focused on Norwegian oil major Equinor and its involvement in controversial sectors such as North Sea oil expansion and Arctic oil and gas extraction.

Together with Justiça Ambiental, Les Amis de la Terre France and ReCommon, we also took the shareholder meetings of ABN AMRO, Crédit Agricole, and Standard Bank as an opportunity to press them for answers in front of their shareholders on their position on the Mozambique and Rovuma LNG projects. Although the majority of banks were vague in their replies, this in itself exposes the lack of due attention given to key climate and human rights questions by some banks.

By handing out information flyers to shareholders as they entered the meetings, we drew attention to ING’s and Barclays’ financing for wood biomass energy, linked to forest destruction. And we targeted BNP Paribas and Barclays, the largest European lenders to companies involved in the maintenance and expansion of illegal Israeli settlements in the Occupied Palestinian Territories, putting them on the spot over their engagement with affected communities and what steps they have taken to avoid being complicit in violations of international law and crimes against civilian populations.

In this AGM round-up we discuss how representatives of frontline communities were received, how collaboration helped put the message across more effectively, and how banks responded to some of the questions raised.

Alarming disrespect for frontline communities needs addressing

Even while banks faced heightened pressure this year, it was clear that they are not giving due attention to the issues raised by shareholders. We felt the palpable frustration from many shareholders at banks sidestepping and greenwashing at most AGMs at which we were present. At Barclays, for example, activist shareholders shouted that they were “done asking questions” after the bank’s board consistently refused to give a clear answer to climate questions.

Even more significantly, a number of banks failed to treat representatives of frontline communities who had travelled to their AGMs with the respect that they deserved. At ING’s meeting, John Beard, who had travelled all the way from Port Arthur, Texas to attend the meeting representing the Port Arthur Community Action Network and using BankTrack’s share, was apparently ignored as his microphone was skipped in favour of others'. Although ING was informed that Mr Beard would be present to ask a question about LNG in the US, the Chair of ING’s Supervisory Board refused to let him speak. After a coordinated effort of climate activists who all asked ING the same question of whether it would commit to reduce emissions with at least 60%, the Chair closed the agenda point in an effort to close down the discussion.

Similarly, Father Edwin Gariguez, who had travelled to Paris from the Phillipines to speak to BNP Paribas about the impacts of the LNG industry there, faced outright racist heckling and hostility from other shareholders in the room. Such behaviour from banks and certain shareholders shows how unwilling banks are to listen to the voices of those most impacted by fossil fuel extraction. Banks, being responsible for the smooth-running of their AGM, have a responsibility to address this and ensure that representatives of communities impacted by their finance are, at a minimum, treated with respect and allowed to speak.

See also this wrap up by Sierra Club on underwhelming action by some investors, who often decide to take a hands-off apparoach to corporation action on climate change. And in this blog, ShareAction explains how some investors are making an impact on European banks, but others booed and shouted down climate-related questions at BNP Paribas' AGM.

Activist shareholders and protesters collaborate

In contrast, we were energised and heartened to see strong collaboration between different NGOs and campaign groups. At many AGMs, different groups made interventions in support of others, piling on the heat in particular around fossil fuel policies and financing. For example, at Standard Chartered, almost all climate questions brought up the bank’s links to Mozambique LNG and potential financing of Rovuma LNG, presenting a united front against financing for these two harmful projects.

Many AGMs were marked by protests outside the venue which gave support to the activists inside. At Barclays, for example, BankTrack engaged the bank directly on its financing of Equinor inside the meeting, while also joining a rally against the bank’s support for JBS outside.

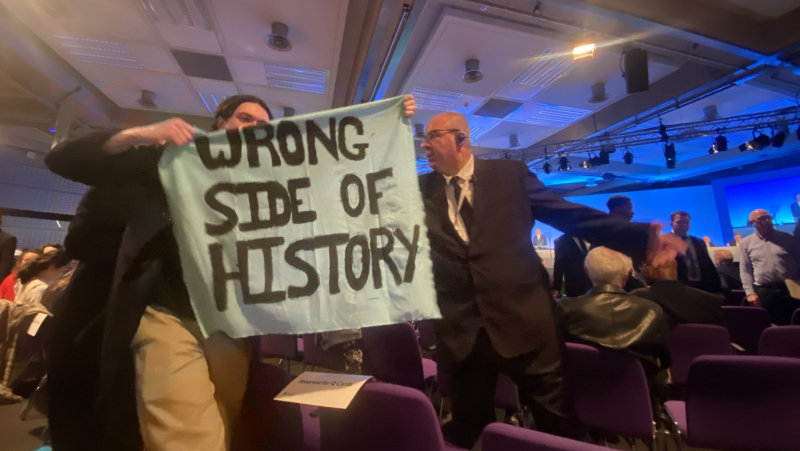

Likewise, at the AGM of Standard Bank organisations including JustShare, Earthlife Africa, Justiça Ambiental, 350Africa and BankTrack coordinated questions on the East African Crude Oil Pipeline (EACOP) and Mozambique gas, while hundreds of protesters gathered outside and inside the AGM venue. Prominent activist Kumi Naidoo, the former head of both Amnesty International and Greenpeace International, was dragged out of the bank’s headquarters by security guards, together with Extinction Rebellion activist Malik Dasoo, after they drew attention to the bank’s role in EACOP. This provided yet another visible example of how banks treat those bearing unwelcome messages.

Bank responses marked by ignorance and misdirection

One thing that was clearer than ever this year was banks’ concerning lack of awareness around the harmful projects and companies they finance. At HSBC, CEO Noel Quinn’s response to a question on the bank’s links to meat packing giant JBS was that he was unfamiliar with the company. A stunning admission given JBS is the world’s largest meat processer, and a company in which Quinn’s bank holds millions of dollars’ worth of shares.

Behind the apparent ignorance displayed by certain board members was a complete refusal by most banks to answer questions with any directness. After we called out Barclays for being the 5th largest European creditor of companies involved in the illegal Israeli settlement enterprise, Barclays CEO C.S. Venkatakrishnan espoused the bank’s adherence to international human rights standards, yet refused to address Barclays’ USD 12.29 billion for surveillance, construction and arms companies in the Palestinian Occupied Territories.

Similarly, Crédit Agricole ignored our questions on Mozambique and Rovuma LNG and instead provided an elaborate response on the dangers of NOT financing gas, claiming that its gas policy is aligned with a Net Zero pathway. The bank claimed that stopping financing new gas projects could pose economic risk to producing countries and slow the transition by encouraging the extraction of more polluting fuels. Yet in doing so, Crédit Agricole ignored the forced displacement and ruined livelihoods linked to the development of LNG in Mozambique, and used the problematic narrative of gas as a cleaner “transition fuel” to dodge the issue of the incompatibility between the financing of new gas projects and a Net Zero pathway.

Yet despite banks’ continued equivocations, this was a year when banks faced visible and heightened pressure for their role in fueling the flames of the climate and nature emergencies as well as human rights abuses around the world. AGMs continue to be a microcosm of bank campaigning itself: a space where an accumulation of pressure points and a range of approaches come together to ramp up the pressure on a financial institution.

Indeed, it’s a success for the bank campaigning world that the worst culprits in the banking sector can no longer get through an AGM without disruption. In this atmosphere of “no more business as usual”, it will be telling how banks respond to the choice in front of them: whether or not to listen to mounting pressure and redirect their policies and finance towards addressing these emergencies.