Banks and Coal

Camilla Perotti, Banks and Coal Campaigner at BankTrack

Camilla Perotti, Banks and Coal Campaigner at BankTrack

From concerns over air pollution and acid rain to its destructive impact on the climate, coal has long been recognised as the dirtiest, most polluting fossil fuel and historically the leading cause of climate change. Globally, the biggest source of carbon dioxide is burning of coal - greater than burning oil or gas, or carbon dioxide emissions caused by deforestation.

These facts have been well established for some time, which has led to coal being the most heavily opposed of all fossil fuels, whether by Indigenous populations, civil society organisations, the general public or the scientific community. Due to this opposition, worldwide emissions from burning coal have been leveling off over the last decade, while emissions from oil and gas continued to rise. However, the trend in emissions from burning coal shows a clear geographical distribution: coal is on the decline in the OECD and EU countries, while it's still on the rise in many parts of Africa, Asia and South America. At the same time, coal mining operations and coal power plants are facing more and more financial difficulties due to the plunging cost of renewable energy and cheap natural gas.

Coal's fast decline

In some parts of the world, like the US and EU, coal has already started its inevitable decline. However, coal's decline is nowhere near the pace necessary to stay within the 1.5 degrees target of the Paris Climate Agreement. In order to meet the 1.5 degrees goal, global carbon dioxide emissions must be more than halved from 2010 levels by 2030 and reach ‘net zero’ by 2050. This gives a 50% chance of staying below a 1.5 degrees temperature increase by 2100.

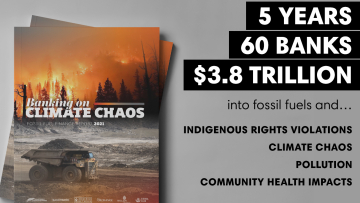

However, coal emissions need to fall about twice as fast as those for oil and gas in the 2020s, which means that global coal emissions should decline by about 80% from 14.5 gigatons CO2 in 2019, to 3.1 gigatons CO2 in 2030. Most developed regions in the world, like the EU, OECD countries and Russia, therefore need to exit coal at the latest by 2030, with the rest of the world following by 2040 at the latest. This means that no new coal mining, coal power or coal infrastructure can be built, and a significant part of the coal industry needs to close before the end of its planned operational lifetime.

Therefore, financing of new coal projects and the companies behind them is incompatible with the temperature goals set in the Paris Climate Agreement. Banks must end support for all new coal activities and implement a full phase-out for financing coal projects and companies in line with the 2030-2040 deadline.

Despite an increase in the number of banks that have restricted or ended their financing for the coal sector, too many banks continue to finance the dirtiest of fossil fuels, making it increasingly hard to avoid climate breakdown.

See here for banks' exposure to fossil fuel expanders in 2016-2023.

At the bottom of this page you can find the campaign pages of up-to-date assessments of bank policies in the Banking on Climate Chaos report on coal mining, coal power and coal infrastructure.

Visit our End Coal Finance campaign website to know more about our most recent campaigning on Banks and Coal.

What banks must do

Banks must phase out finance for coal across all their financing activities, including corporate financing in the form of loans and underwriting, which now accounts for the majority of bank financing to the coal industry. In order to achieve this, banks must:

- Adopt policies immediately excluding new finance for projects & companies expanding coal production

- Endorse the Fossil Fuel Non-Proliferation Treaty

- Adopt policies phasing out all coal finance by 2030 in OECD countries and in 2040 elsewhere

Coal Policy Tool

Reclaim Finance tracks the oil and gas policies of financial institutions, including banks, in the Coal Policy Tool. The below shows the assessments for commercial banks. The table can be filtered by Country and for NZBA membership (more on that see here). For more information about the tool and methodology, see www.coalpolicytool.org

Feedback welcome

Our policy assessments are always a work in progress and we very much welcome any feedback, especially from banks included in them. You can of course also contact us for more information on specific scores and the latest policy changes. Please get in touch at climate@banktrack.org.

.jpg&cropratio=16:9&width=360)