Banks and Steel

Julia Hovenier, Banks and steel campaigner

Julia Hovenier, Banks and steel campaigner

Fossil fuels are currently the backbone of the steel industry, but it doesn’t have to be this way. With a material as pervasive as steel, it is essential to reduce demand, and transform the industry towards fossil-free production. Steel has an important role in building a greener and more equitable future. But unfortunately, 14% of global coal is consumed by the steel industry. As a result, the industry is responsible for 11% of carbon dioxide (CO2) emissions, and 7% of greenhouse gas emissions (GHG) globally. In order to remain below 1.5°C of global heating, the International Energy Agency (IEA) estimates that the steel industry's emissions must be reduced by 25% by 2030 and almost 92% by 2050.

Currently, the steel industry is far off track. As of 2024, 68% of the world’s steel production is coal-based, relying on blast furnace technology to turn iron ore into crude steel. Additionally, even before coal makes it to the steel plant, the methane emitted from metallurgic coal mining can double the warming potential of a batch of steel.

Alongside its climate impact, coal-based steel production causes a wide variety of adverse health effects on workers and communities surrounding steel plants. Communities living in proximity to steel plants are shown to have significantly higher rates of lung cancer, asthma, and heart disease, caused by the dust and chemical emissions released from processing and burning coal.

The steel industry has long been considered a ‘hard to abate’ sector, notably because it is such a crucial resource for other industry sectors and because no commercially viable alternatives were available to decarbonize the production process. However, fossil-free alternatives are now available.

Besides producing less, there are two dominant pathways to reduce the climate impact of steel production. The first is melting down and recycling scrap steel into new steel using an electric arc furnace. A ton of crude steel produced using an electric arc furnace emits an average of 0.04 ton of CO2, versus blast furnaces, which result in 1.2 tonnes of CO2 per ton of crude steel. The second way is a more recent technological innovation, where hydrogen, rather than coal, is used to convert iron ore into crude steel. In Sweden, there are two pilot plants producing steel that is 100% fossil-free using green hydrogen. Ramping up recycling, and utilising green hydrogen provide a far stronger outlook for reducing the climate impact of steel production than Carbon Capture Utilisation and Storage (CCUS), which has a history of underperforming.

Even as green production methods become available, making new steel from iron ore has a human and environmental cost. The iron ore industry has a notoriously poor human rights and environmental track record, especially in the Global South. An ecologically and socially just transformation of the steel industry therefore also requires decreasing demand and ending extractivism. Reducing our demand in turn requires reducing demand for the largest buyers of steel, such as the automotive industry and construction. With steel production projected to grow by a third by 2050, banks must ensure that their steel clients are meeting demand using fossil free technologies.

The role of banks

This decade is crucial in the transition to fossil-free steel. There are 252 new and unnecessary metallurgical coal mines in the pipeline globally, and before 2030, 71% of existing blast furnaces will reach the end of their lifetimes, and require reinvestments.

The steel industry will require massive amounts of capital to transition coal-dependent furnaces to fossil-free assets, and the COP29 climate finance agreement makes it clear that much of this money will come from private finance. But since 2019, just 7.2% of the total debt provided for the steel sector was earmarked for decarbonisation (i.e. classified as transition, green or sustainability-linked loans/bonds).

Commercial banks hold significant leverage over the steel and metallurgical coal industries. Between 2016 and June 2023, commercial banks provided US $557 billion in finance to the metallurgical coal industry, and over US $429 billion to the steel industry.

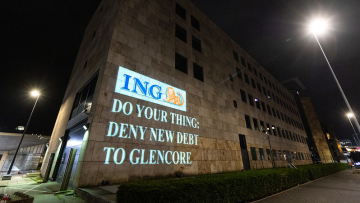

For such large exposure to high-risk industries, commercial bank policies are shockingly weak. While 184 commercial banks globally have policies to restrict finance for thermal coal, only 15 banks have policies that restrict finance for metallurgical coal. While many banks have set targets for steel decarbonisation under the Net Zero Banking Alliance, only one bank - ING - has an explicit policy to not finance the construction of new unabated blast furnaces. Six banks have also joined the Sustainable STEEL Principles, a voluntary measurement and disclosure framework for steel portfolio emissions. But voluntary initiatives don’t go far enough, and can easily be backtracked.

What banks must do

To enable a just transition to fossil-free steelmaking, banks must:

-

Adopt policies to immediately end finance for companies building new, or expanding metallurgical coal mines

-

Adopt policies to immediately end finance for the expansion of fossil-based steel manufacturing

-

Increase finance for a just transition to fossil-free steel manufacturing, including enabling infrastructure

-

Exclude false solutions from green/clean/sustainable finance frameworks (namely: carbon capture, utilization and storage on blast furnaces, hydrogen injections in blast furnaces, and mass balance approaches)

What BankTrack does

BankTrack’s Banks and Steel project works towards achieving three long-term goals:

- Banks end finance for companies building new, or expanding metallurgical coal mines

- Banks end finance for the expansion of fossil-based steel manufacturing

- Banks increase finance for fossil-free steel manufacturing, and it’s enabling infrastructure

To achieve these goals we use the following tactics:

-

Mapping finance flows We conduct research on bank finance for specific projects and companies expanding coal-based steel production, and metallurgical coal mining around the world. We supported Reclaim Finance with the publication of two reports identifying the largest financiers of steel and metallurgical coal industries.

-

Strengthen bank policies BankTrack’s Net Zero Banking Alliance Iron and Steel Target tracker monitors the commitments made by commercial banks on steel decarbonisation. Additionally, we support Reclaim Finance’s Coal Policy Tool with research on new metallurgical coal policies. We use these policy assessments to push for policies that end finance for coal-based steel expansion.

-

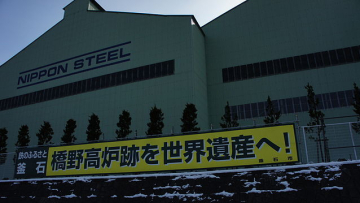

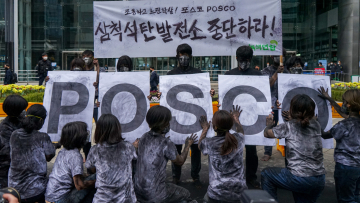

Target Dodgy Deals We target banks involved in financing specific steel and metallurgical coal projects and companies that violate human rights, accelerate the climate crisis, and threaten critical nature. We campaign for banks to either end or refrain from financing or exert their influence on clients to make them conduct their business responsibly. Our target Dodgy Deals include ArcelorMittal, JSW Steel, Nippon Steel, and Glencore.

-

Engage with banks We engage with the 50 largest financiers of both the steel and metallurgical coal industries on their commitment to decarbonisation, to provide advice on how to strengthen their policies and processes.

-

Engage with bank stakeholders We engage with a range of bank stakeholders, including affected communities, shareholder groups, and voluntary initiatives like the Sustainable STEEL Principles.

-

File complaints Where appropriate, we may file complaints on bank financed activities with relevant recourse mechanisms, such as those of development banks and the National Contact Points of the OECD.

-

Strengthen movements We provide training to fellow campaigners on the state of steel and metallurgical coal finance, and how to campaign against it. We also assist stakeholders directly affected by bank financed steel and metallurgical coal projects and companies in their engagement with banks, and support the finance strategies of groups like the European Fossil Free Steel Network, and the Fair Steel Coalition.

Reclaim Finance tracks the metallurgical coal policies of financial institutions, including banks, in their Coal Policy Tool. BankTrack works closely with Reclaim Finance and endorses their policy assessments.

As part of the Net Zero Banking Alliance (NZBA), many banks are required to set targets to reduce the financed emissions of their steel lending. We track bank's iron and steel decarbonisation targets as part of our NZBA tracker.

Video Volunteers.png&cropratio=16:9&width=190)