Reporting from COP15: Beyond Burning

Natasha Ion, Climate campaigner at BankTrack

Natasha Ion, Climate campaigner at BankTrack

COP15

From the 7th until 19th December 2022, governments meet in Canada for the 15th Conference of the Parties (COP) to the Convention on Biological Diversity (CBD). BankTrack will monitor news related to banks and biodiversity during the conference on this page.

COP15 takes place as the world faces multiple, urgent and overlapping global crises. We are facing an acute and rapidly accelerating climate crisis and the planet is heading towards ecological breakdown, which further exacerbates the probability of new pandemics emerging. At the same time, human rights continue to be violated around the world and people are struggling to cope with the immediate consequences of these global crises. It is clear that urgent and decisive action is needed to tackle each of these crises and no one can be solved without addressing the others.

The conference also comes closely after governments met in Egypt for COP27 of the UN Framework Convention on Climate Change (UNFCCC). This conference was marked by successes, particularly the historic Loss and Damage fund, but also major failures, including a final agreement that does not acknowledge all fossil fuels as the root cause of those damages, let alone commit to phase them down or out. You can see more about the bank related news coming out of COP27 in our wrap-up blog.

Biodiversity protection was sidelined during COP27, but it is the main topic being discussed at COP15 as governments negotiate the long-expected Post-2020 Global Biodiversity Framework. BankTrack will be in Montreal focused on getting banks to stop financing the expansion of industries that are driving biodiversity loss, including industrial agriculture, fossil fuels and wood biomass.

Find all BankTrack news related to COP15 and COP27 here

Time to move banks beyond burning

Banks play a key role in facilitating the global crises facing society today through the finance they provide to companies or projects that are impacting on nature. While the science is clear that in order to maintain a healthy and livable planet for all we must address the key drivers of biodiversity loss, banks continue to pump huge amounts of money into high risk industries such as industrial agriculture, fossil fuels, wood biomass and other sectors that continue to expand at the expense of nature.

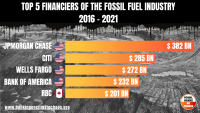

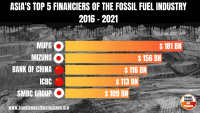

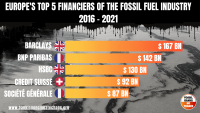

Leading financial institutions have pumped USD 267 billion into forest-risk commodity companies since the Paris Agreement, and as of September 2022, investors held USD 40 billion in bonds and shares in those companies destroying the world’s precious forests. Between 2016 - 2021, the world's largest 60 banks financed the fossil fuel industry to the tune of USD 4.6 trillion. This does not match up to their “net zero” commitments or their climate or biodiversity pledges. Additionally, banks are providing finance to the wood biomass industry that has been falsely labelled as renewable, despite its significant carbon emissions.

We are calling on banks to move beyond burning fossil fuels and biomass for energy; beyond burning our planet by facilitating deforestation and accelerating the climate crisis; and beyond burning our future of a healthy and livable planet for all.

To read more about how banks can act urgently and decisively to address these global crises and redirect their finance to those businesses that are supporting a just and equitable transition, see here: on nature; on climate; and on human rights.