Tracking the Net Zero Banking Alliance

Quentin Aubineau, Banks and climate policy analyst

Quentin Aubineau, Banks and climate policy analyst

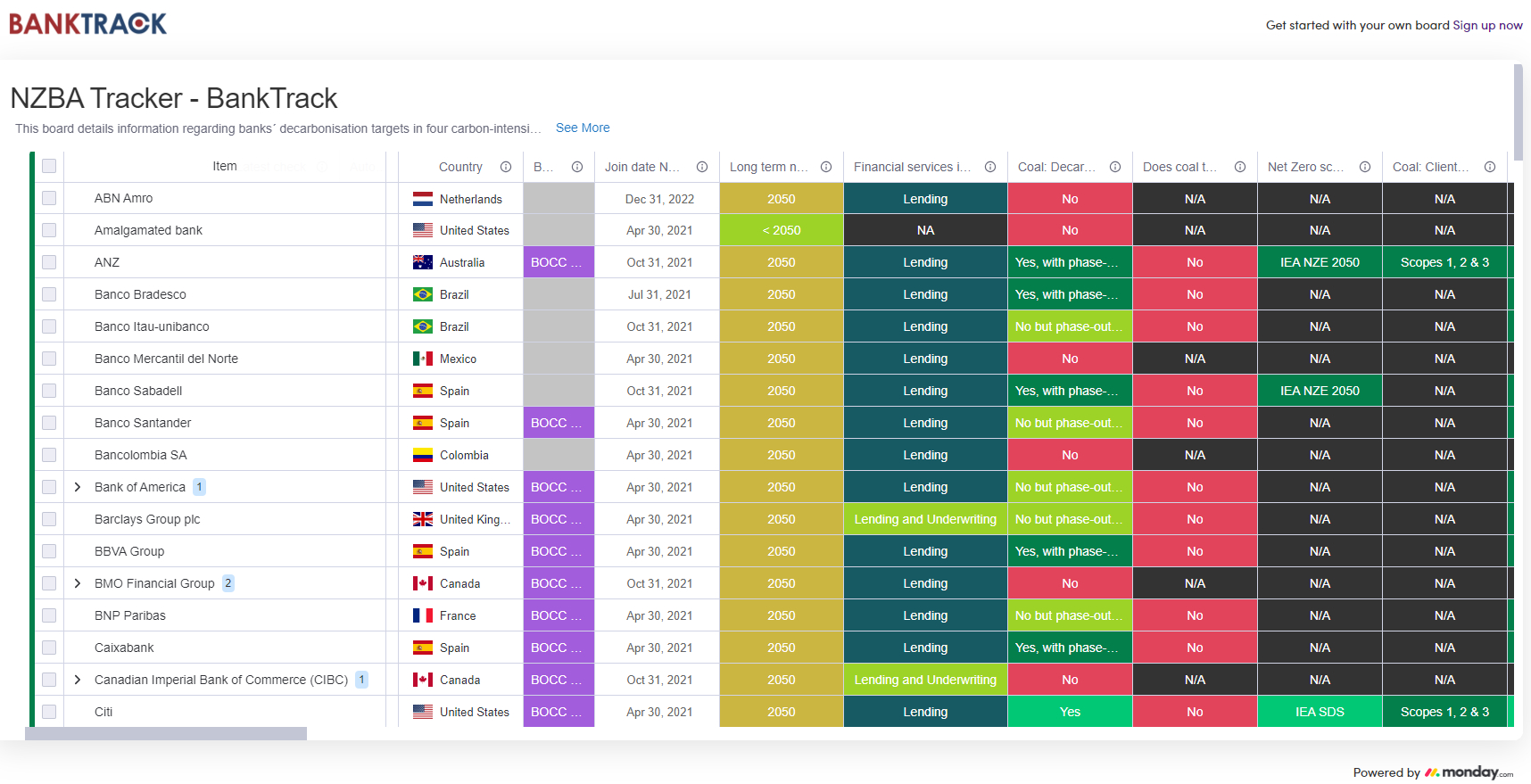

Tracking NZBA bank commitments

BankTrack monitors whether individual NZBA member banks deliver on their stated commitments as part of the NZBA. Go to the 'policy analysis' section for more details per bank.

NZBA

The Net Zero Banking Alliance (NZBA), founded in April 2021 is convened by the UN Environment Programme Finance Initiative and is the climate-focused initiative of the also UN-convened Principles for Responsible Banking. It brings together 135 banks from 44 countries, which have committed to bringing down the emissions from their lending and investment portfolios to ‘net-zero’ by 2050, in line with a 1.5ºC climate scenario. Banks that sign up to the NZBA commit the following:

-

Transition all operational and attributable GHG emissions from their lending and investment portfolios to align with pathways to net-zero by 2050 or sooner, consistent with a maximum temperature rise of 1.5ºC;

-

Use decarbonisation scenarios which: are from credible and well-recognised sources; are no/low overshoot; rely conservatively on negative emissions technologies.

-

Prioritise efforts where they have, or can have, the most significant impact, i.e. the most GHG-intensive and GHG-emitting sectors within their portfolios.

-

Use the bank-led UNEP FI Guidelines for Climate Target Setting for Banks to set scenario-based intermediate targets for 2030, or sooner, for priority GHG-intensive and GHG-emitting sectors.

-

Publish annually and share with UNEP FI for review, to monitor consistency with the UN Race to Zero criteria and evidence that action is being taken in line with:

-

Progress against absolute emissions and/or emissions intensity targets following relevant international and national GHG emissions reporting protocols and/or climate portfolio alignment methodologies.

-

Progress against a board-level reviewed transition strategy setting out proposed actions and climate-related sectoral policies;

-

Disclosure for key sectors will be made within one year of setting the target.

-

-

Contribute to the ongoing development of the NZBA Guidelines.

How signatory banks must meet these commitments is further elaborated in NZBA’s Version 2 of the “Guidelines for Climate Target Setting for Banks” and the supporting notes document, which are reviewed at least every three years.

After the publication of the latest version of the Guidelines in March 2024, disagreements within the NZBA came out when three progressive NZBA member banks - Amalgamated Bank, Ecology Building Society and Triodos Bank - warned that “the language used provides too much latitude for banks” and called “to raise the bar in developing policies and disclosures for the highest emitting sectors and ensure a faire and fast transition to a liveable planet”.

In December 2024 and January 2025, the six major US banks withdrew from the NZBA and were followed by five Canadian banks.

GFANZ

The NZBA is part of a bigger alliance called the Glasgow Financial Alliance on Net Zero (GFANZ). Launched in April 2021 by UN Special Envoy on Climate Action and Finance Mark Carney, GFANZ consists of eight-specific alliances, namely the Net Zero Asset Manager initiative (NZAM), Net Zero Asset Owners Alliance (NZAOA), Paris Aligned Asset Owners (PAAO), Net Zero Financial Service Providers Alliance (NZFSPA), Net Zero Investment Consultants Initiative (NZICI), Net-Zero Export Credit Agencies Alliance (NZECA), the Venture Climate Alliance (VCA) and the Net Zero Banking Alliance (NZBA).

GFANZ initially seeked to “increase the number of firms with net-zero commitments within the financial sector and ensure that such institutions have a vehicle through which to set their own, independent, credible net-zero commitments” and “encourage firms to set commitments that are backed by robust targets and transition plans”. However, GFANZ announced in January 2025 that it will restructure and shit its focus to "addressing barriers to mobilizing capital" and now acts as a "stand-alone" private-sector group, no longer as an umbrella for the eight-specific alliances.

Why is this important to track?

Since its launch, the Net Zero Banking Alliance has emerged as the central initiative claiming to align the banking sector with the 1.5°C Paris climate goals. For most banks, ‘aligning with Paris’ means bringing down financed emissions to ‘net-zero’ by 2050. But there are serious issues with this approach:

-

Net zero is not zero. The ‘net’ refers to an approach in which continued emissions from some ‘hard to abate’ sectors will need to be compensated through all sorts of offset schemes that are highly problematic for a range of reasons;

-

2050 is too far away. While it will take time to transition entire business sectors to a low/no carbon trajectory, the bulk of action to bring down emissions must be taken right now. Since the launch of the NZBA, too many banks have been busy ‘target setting’ when the climate emergency is requiring immediate and decisive action;

-

Net zero must mean ending finance for fossil fuels. The key decision that all NZBA banks should have already made by now is to stop financing, directly and indirectly, the fossil fuel industry, or at a minimum all coal and the further expansion of oil and gas. However, no less than 42 of the 60 banks that BankTrack and partners have identified as ‘Fossil banks’ are NZBA members, illustrating that for banks, it is perfectly compatible to keep financing fossil fuels expansion while being an NZBA bank.

By tracking the commitments and actions of banks, BankTrack aims to ensure that signing up to the NZBA means that a bank will phase out its fossil fuel financing, starting with an immediate end to all finance for fossil fuel expansion, and will speed up target-setting for all other high emissions sectors. Besides, it is crucial to demand that decarbonisation targets are actually supported by concrete sectoral measures such as coal, oil and gas exclusion policies.

Tracking NZBA bank commitments

BankTrack monitors whether individual NZBA member banks deliver on their stated commitments as part of the NZBA. Considering that several banks left the NZBA between December 2024 and January 2025 but indicated that they would continue their climate efforts, BankTrack keeps monitoring ex-NZBA member banks in a dedicated section of its tracker. Click on the picture below for more details per bank. Sector specific boards are also available for Coal, Oil & Gas, Power Generation and Iron & Steel.