Banks and Nature

Ola Janus, Campaign Lead Banks and Nature, ola@banktrack.org

Ola Janus, Campaign Lead Banks and Nature, ola@banktrack.org

A global crisis

The living systems of our planet are collapsing, crumbling under the weight of extractive, fossil-fueled modes of production and consumption that characterise the prevailing global economic model. This model not only fails to address the fundamental needs of most people, creating staggering inequality instead, but actively ravages life on Earth by generating colossal amounts of waste, causing the mass annihilation of plant and animal species, and undermining the stability and resilience of life-sustaining ecosystems. Untouched wilderness areas are fast disappearing, with human activity having already significantly altered three-quarters of all land and impacted two-thirds of the seas and oceans. Industrial farming and fishing, logging, resource extraction and waste disposal and other activities all severely impact on temperate and tropical forests, peatlands, wetlands, coral reefs, rivers, oceans and other ecosystems. Sadly, their condition is deteriorating more rapidly than ever, further aggravated by steadily rising global average temperatures due to accelerating climate change.

Linked to other crises

The crisis of nature cannot be separated from other global crises. Climate-related disasters such as forest fires, droughts and floods destroy and disrupt ecosystems globally. At the same time, tackling the climate crisis requires protecting and restoring ecosystems, as forests, peatlands and oceans store vast amounts of carbon, but also because healthy ecosystems act as natural buffers against the impacts of extreme weather. Preserving intact wilderness areas from human interference and encroachment is also crucial to reducing the risk of new pandemics emerging.

Effectively protecting and restoring nature requires strengthening human rights, in particular those of the Indigenous peoples and local communities that are on the front line. Indigenous peoples embody and nurture 80% of the world’s cultural and biological diversity, whilst only occupying 20% of the world’s land surface and comprising less than 5% of the world’s population. As traditional custodians of the land, they are central to any attempt to preserve nature, yet their rights are continually violated by the colonial, extractive and industrial activities of the fossil fuel, agro commodities- and other high-impact sectors operating on their territories, often without their consent. Every day, land and environmental defenders are facing a host of human rights violations in efforts to silence their calls to protect their way of life -on average four are killed each week. If protection and restoration of nature is our best chance at keeping our planet habitable, we must learn from those who best protect these most valuable ecosystems.

Role of banks

It is not the primary role of a bank to “protect nature”. Banking revolves around financial intermediation, facilitating transactions, while managing risks associated with lending and investment activities. Traditionally, banks do not see ecological breakdown and the collapse of living systems as a serious risk material to their operations, but this is now rapidly changing, driven by mounting evidence that banks are exposed to severe physical and transition risks stemming from biodiversity loss. This implies a clear direct interest and responsibility for banks to systematically manage and reduce these risks.

Through their lending decisions and client selection, banks can choose whether they want to participate in fuelling the ongoing destruction of nature. Despite the ecological breakdown we find ourselves in, many banks continue to finance habitat destruction and turn a blind eye to associated human and Indigenous rights violations. Since the 2015 Paris Agreement, banks have provided US$ 307 billion in credit to the production of beef, palm oil, pulp and paper, rubber, soy, and timber in the world’s three major tropical forest biomes: Southeast Asia, South America, and Central and West Africa.

Banks can halt the ongoing disappearance of the Earth's biosphere if they stop financing business activities in high-risk sectors and develop robust policies and practices that guide them towards financing sectors and clients that deliver shareholder value without devouring the planet.

What banks must do

The overall aim of the Banks and Nature campaign is to stop banks from financing nature destruction and push them to halt and reverse environmental collapse. To achieve this, banks must:

-

Acknowledge: Banks must acknowledge their distinct responsibility to help protect nature and express a firm commitment to disengage from any activities that contribute to species extinction and ecosystem destruction.

-

Commit: Banks must commit to contribute to achieving the 2030 goals and targets of the Global Biodiversity Framework (GBF). Banks must publish transition plans with time-bound goals for aligning their policies and financing activities with the targets of the GBF and the Paris Climate Agreement, before the Conference of the Parties to the UN Convention on Biological Diversity (CBD) in Cali, Colombia, in October 2024 (COP16).

-

Reduce impact: Under Target 15 of the GBF, banks should monitor, assess, and transparently disclose their biodiversity risks, impacts, and dependencies, to progressively reduce the negative impacts of their financing on biodiversity and increase their positive impacts.

-

Adopt No-go policies: Banks must restrict their financing activities in all the 8 different No-Go Areas identified by the Banks and Biodiversity coalition. These include areas recognised by international conventions and agreements; nationally and sub-nationally recognised areas, habitats with threatened and endemic species and Key Biodiversity Areas; intact primary forests and vulnerable, secondary forest ecosystems; free-flowing rivers; protected or at-risk marine or coastland ecosystems; areas where the Free, Prior & Informed Consent (FPIC) of Indigenous Peoples and local communities have not been obtained; and Iconic Transboundary Ecosystems. Given the severity of the biodiversity crisis, it should become industry standard that no direct or indirect financing is provided for unsustainable, extractive, industrial, environmentally, and/or socially harmful activities in these areas.

-

Exclude high-risk sector financing: Banks should immediately set exclusions for the most harmful activities and businesses that have no potential or credible transition pathways such as industrial meat, deep-sea mining or burning woody biomass for power and heat generation.

-

Reject: Banks must reject false solutions to the biodiversity crisis, such as carbon and biodiversity offset projects based on the concept of “no net loss” to achieve net-zero targets or mitigate project impacts.

-

Drop clients: Banks must break ties with the most egregious companies in the forest risk sectors that are known for their environmental crimes and human rights abuses.

-

Support regulation: Banks must not rely solely on voluntary corporate initiatives based on self-reporting, and frameworks such as the Taskforce on Nature-related Financial Disclosures (TNFD), but accept that national and international regulation is necessary to ensure transparency and accountability. Governments and regulators must develop and strengthen legislation that requires companies and financial institutions to limit their impacts on biodiversity, and hold them accountable when they do not meet such requirements.

What BankTrack does

BankTrack’s Banks and Nature campaign challenges commercial banks to act urgently and decisively to halt and revert ongoing nature destruction. In 2024, we work toward achieving five long-term goals:

-

Banks commit to protecting biodiversity in line with the goals and targets of the Kunming-Montreal Global Biodiversity Framework (GBF) before COP16 in Colombia.

-

Banks adopt or strengthen policies for business sectors with a high impact on nature and biodiversity.

-

Banks stop financing the use of wood biomass for power generation.

-

Banks stop financing the further expansion of the global meat industry.

-

Banks stop financing virgin polymer and single-use plastic production.

Additionally, we will continue to monitor the nature & biodiversity bank commitments under voluntary bank initiatives (EP, PRB, TNFD). To achieve these goals we use the following tactics:

-

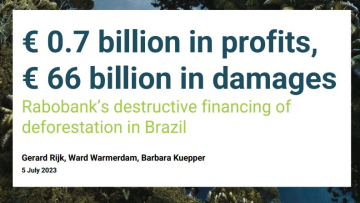

Mapping finance flows: BankTrack is a member of the Forest & Finance Coalition, which manages a comprehensive open-access database on bank finance and investment in 300 companies directly involved in forest-risk sectors such as beef, soy, palm oil, pulp and paper, rubber and timber. This includes the publication of the flagship Banking on Biodiversity Collapse (BOBC) report and other research activities to inform our own Dodgy Deal campaigning.

-

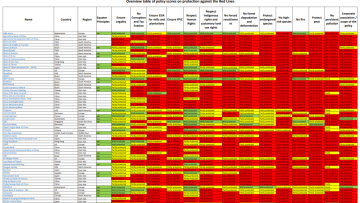

Strengthen bank policies: The Forest & Finance coalition also conducts policy assessments of 200 financial institutions that have significant financial exposure to forest-risk sectors in Southeast Asia, Central and West Africa and parts of South America. We use this analysis to engage with banks on further strengthening their policies, seeking to instigate a race to the top between peer banks on policy commitments.

-

Target Dodgy Deals: in collaboration with affected communities and other partners we campaign for banks to address the negative impacts of specific projects and companies with severe adverse impacts on climate, human rights and nature. Examples include the Brazilian meat-packing company JBS and the UK energy company Drax which is heavily involved in the burning of wood for energy.

-

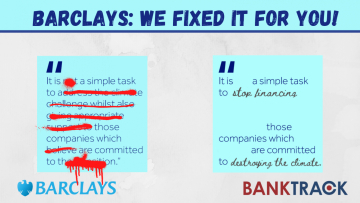

Engage with banks and banking initiatives: We directly engage with banks to raise standards, either in banks’ own policies or as part of financial sector initiatives. Together with partners, the Banks and Nature campaign organises calls and webinars with banks on their commitments to nature. We also attend Annual General Meetings (AGMs), bringing issues such as deforestation directly to the Board. BankTrack, Rainforest Action Network and other CSOs have all raised concerns to the Taskforce on Nature-related Financial Disclosures (TNFD) about the serious risks of accommodating greenwashing. In addition, we monitor and engage with banking initiatives such as Equator Principles and the Principles for Responsible Banking to seek further commitments to nature and biodiversity protection.

-

Engage with bank stakeholders: BankTrack, together with partners, advocates with governments and regulators for strong regulation to stop banks from financing projects and companies that have devastating impacts on nature and local communities.

-

File complaints: Where appropriate we file complaints on bank-financed activities with relevant recourse mechanisms, such as those of development banks and the National Contact Points of the OECD.

-

Strengthen movements: Our website provides extensive information for civil society to use. We take part in coalitions including the Drop JBS coalition, convening on private finance in industrial animal agriculture; the Banks & Biodiversity coalition; the Environmental Paper Network’s Biomass Finance Working Group and Pulp Finance Working Group. We organise ‘Finance for Campaigners’ courses to empower others seeking to target finance in their campaigns.

Current Dodgy Deal targets

Latest publications