Project – On record

This profile is no longer actively maintained, with the information now possibly out of date

Project – On record

This profile is no longer actively maintained, with the information now possibly out of dateWhat must happen

Now that the pipeline is operating Financial institutions must ensure full compliance with relevant safety, technical, social and environmental standards and commitments.

| Sectors | Pipeline Transportation of Crude Oil |

| Location |

|

| Website | http://www.bp.com/en_az/caspian/operationsprojects/pipelines/BTC.html |

|

|

This project has been identified as an Equator Project |

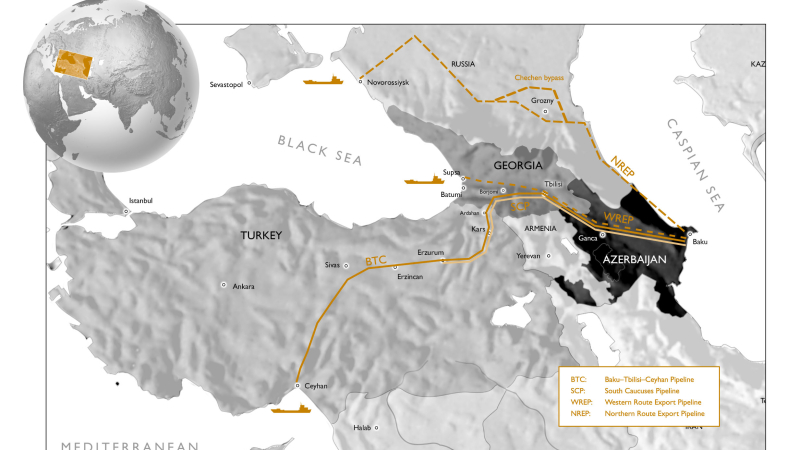

The controversial $4 billion Baku-Tbilisi-Ceyhan pipeline through Azerbaijan, Georgia and Turkey received $2.7 billion of public and private loans.

Social and human rights impacts

The project has caused economic and physical disruption to hundreds of communities along the route, while delivering no energy to them: despite the severe energy poverty in region, the oil is destined for the West. The pipeline required the confiscation of people's land; many received meagre or no compensation. In Turkey, affected people received less than the value of a cigarette packet per square metre, encouraging further migration away from their villages.

BTC passes through or near seven different conflict zones, encouraging antagonism. It has led to the creation of a 1,000-mile militarised corridor through three countries that are known for their poor human rights record. The Azeri government has stated publically that it will use BTC-revenues to build up its army to threaten Armenia. Agreements signed between BP and the three host governments have been described as 'colonial', as they bypass social, environmental and other domestic legislation, giving effective sovereignty to BP and its partners.

Environmental and climate impacts

In Georgia, the pipeline passes through the pristine Borjomi Nature Reserve, Georgia's foremost natural resource and site of Borjomi mineral water springs, an important export product. Watersheds are threatened and local water sources were already polluted during construction. BTC passes through a region of northern Turkey which suffers from severe seismicity, where earthquakes have been known to level whole cities. Up to three supertankers per day will leave the port of Ceyhan in Turkey, threatening the viability of fishing in the area. Once in full production, BTC will transport one million barrels of oil a day. When burnt, this will produce 160 million tonnes of Carbon Dioxide (CO2) each year. This is equal to the pollution from every power station in the UK (163 million tonnes CO2).

Other impacts

Failed Construction Standards

Whistleblowers working on the Turkish section raised serious concerns regarding inordinate cost-cutting and a lack of safety standards. In some cases, necessary seismic experts were not hired, in order to reduce costs further. The anti-erosion coating used in Georgia and Azerbaijan was shown to be faulty and wholly unsuitable for such a pipeline. BP's ignored its own consultants who warned that that it would lead to major leaks. Application of the coating continued, despite an internal report for BP showing 25% failure rates in Georgia.

Applicable norms and standards

2011

2011-05-26 03:42:26 |

The BTC pipeline is operational since the summer of 2006. In the autumn of 2008 the operation of the pipeline was disrupted several times because of sabotage and war threat. The financial institutions involved in the project have committed themselves to monitor the impacts of the pipeline for the upcoming years.

In February 2011, the UK government ruled that the BP-led consortium was breaking international rules governing the human rights responsibilities of multinational companies in its operations on the controversial Baku-Tbilisi-Ceyhan oil pipeline. The ruling follows the Complaint lodged under the OECD Guidelines for Multinational Enterprises by six groups in April 2003. Environment and human rights groups, which had filed an official complaint against BP eight years ago, say the ruling puts the oil multinational in breach of its loan agreements.