Project – On record

This profile is no longer actively maintained, with the information now possibly out of dateclimate@banktrack.org

Project – On record

This profile is no longer actively maintained, with the information now possibly out of dateclimate@banktrack.org

Why this profile?

The Rovuma LNG project will displace thousands of people, thereby triggering considerable social and human rights impacts. It also threatens a large number of plant and animal ecosystems. Furthermore, in a world aiming for zero greenhouse gas emissions, the enormous quantity of emissions represented by Rovuma LNG is irreconcilable with the goals of the Paris Climate Agreement.

What must happen

Banks and other financial institutions must refuse finance for the Rovuma LNG project due to its severe adverse impacts on human rights, nature and climate change.

| Sectors | Oil and Gas Extraction , LNG Terminal, Pipeline Transportation of Natural Gas |

| Location |

|

| Status |

Planning

Design

Agreement

Construction

Operation

Closure

Decommission

|

| Website | https://www.exxonmobil.co.mz/en-MZ/About/Who-we-are/Rovuma-LNG |

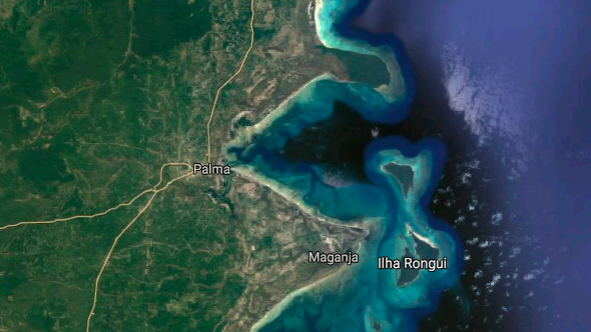

The Rovuma LNG project plans to liquefy and market 15.2 million tonnes of natural gas per year from Northern Mozambique. The gas will be extracted from Area 4 of the Rovuma Basin, which comprises the Mamba and Coral gas fields; this project will exploit Mamba. A 45-kilometre subsea pipeline will bring gas ashore to the Afungi LNG Park. A dock, jetty and two airstrips will also be built. In 2020, the estimated cost of the project was USD 30 billion. The initial construction phase (two liquefaction trains and associated onshore facilities), was estimated at USD 500 million in January 2022. Each train is expected to transport 8.2 million tonnes of LNG per year. The facility is projected to operate for at least 30 years from 2025.

Impact on human rights and communities

The forced displacement of hundreds of rural families has occurred since Cabo Delgado’s gas reserves were discovered in 2007 to make way for the LNG onshore facilities including the Afungi LNG Park. This figure stood at 556 families by March 2020, which is expected to rise to thousands of displaced families as the area’s various LNG projects progress. A 2014 Environmental Impact Assessment (EIA) by Anadarko – the former majority shareholder of the Mozambique LNG Project, which is planned for the same region – states that those living in the Afungi Project Site will be permanently displaced. In 2019, an African Development Bank Group report estimated that 2,700 people live there. Locals will also lose access to collective natural resources including forests, floodplains and grasslands.

Loss of livelihoods: the forced displacement also deprives many of livelihoods. Local agriculture and fishing has long provided sustenance and trade. However, fishing communities have been moved 10 kilometres inland and people have been compensated with much smaller plots of land compared to their old plots. The literacy rate in the region is very low, which severely limits formal employment opportunities for those being displaced.

Major community health impacts are predicted by the 2014 EIA (page 17), which will occur due to an influx of project workers into the area. For example, there will be a rise in the transmission of diseases such as COVID-19, which has already occurred in areas impacted by the Mozambique LNG project. The project is also expected to generate huge amounts of sulphur dioxide pollution.

Social unrest and militarisation of the Cabo Delgado region: the growth of the fossil fuel industry in the region and its impacts on local communities who continue to live in poverty, together with unmet political and corporate promises, has fuelled social unrest. This social unrest has led to insurgent attacks. Insurgents deliberately kill civilians, loot their homes, burn villages and towns and commit atrocities such as beheadings.

An Islamist insurgency dating back to 2018 triggered a security deal between TotalEnergies and the Mozambican authorities, in relation to the former’s Mozambique LNG Project. To protect LNG interests, the government provides troops who intimidate and mistreat local communities. Widespread destruction, mass displacement and death has caused untenable humanitarian conditions for the hundreds of thousands who have fled and are now refugees.

The suppression of journalism has increased in Cabo Delgado as a direct consequence of the gas region’s increased militarisation. Reporters have been detained, or simply gone missing. More information can be found on the profile of the Mozambique LNG project.

Impact on climate

The project’s own 2014 EIA (page 14) estimates that once the pipeline is operational, it will increase Mozambique's global contribution to greenhouse gas emissions by up to 10% per year. According to the International Energy Agency, any expansion of fossil fuel extraction is incompatible with a pathway to limiting the global temperature rise to 1.5 °C and therefore with net zero by 2050 commitments.

Impact on nature and environment

Construction damage and depletion of biodiversity: construction activities will disrupt Palma Bay’s seagrass, coral reefs and the organisms that depend on them, caused by the dredging of the area. Dredging, as well as cutting, also leads to the deposit of sediments on these fauna, which can take a lot of time to recover. The anticipated increase in noise pollution will adversely affect fish, dolphins, turtles and whales. This assault on the area’s biodiversity will also be felt at the onshore Afungi construction site, where the disturbance of wetland areas will affect reptiles, amphibians and birds. Finally, the area’s topsoil will suffer losses during the construction phase. Each of these consequences is acknowledged in the 2014 Environmental Impact Assessment.

The LNG projects are located in an area with unique and vulnerable ecosystems important for biodiversity such as mangrove forests, coral reefs and seagrass beds, including the Quirimbas National Park, a UNESCO Biosphere Reserve. This biodiverse group of islands spans the Cabo Delgado coast and is home to endemic plants, a rich marine ecosystem including turtles, dolphins and sharks, and a range of land animals such as lions, elephants and leopards. More information can be found on the profile of the Mozambique LNG project.

The Rovuma LNG Project has an estimated cost of USD 30 billion, but a Final Investment Decision has been postponed repeatedly. In June 2020, Crédit Agricole was cited as the project’s financial advisor.

By March 2020, several export credit agencies were in talks to help finance Rovuma, including Sinosure China, South Korea's Kexim and K-Sure, JBIC in Japan and South Africa's ECIC. Six months later, it was reported that ExxonMobil had cancelled an application for USD 2 billion in funding via the Export-Import Bank of the US, possibly due to new, China-related financing restrictions.

The project has one known investor: The United States' International Development Finance Corporation is providing USD 1.5 billion in political risk insurance.

Following BankTrack's engagement with potential financiers, BNP Paribas and ING both provided public statements on ruling out finance for the project.

- BNP Paribas' public response is: “BNP Paribas will not be financing the Rovuma LNG project”.

- ING states: “ING is not involved in the project”.

We also understand that UniCredit will not finance the Rovuma LNG project, given that the project is not in line with their policy on the oil & gas sector.

This project is jointly owned by Mozambique Rovuma Venture (MRV), Empresa Nacional de Hidrocarbonetos (ENH; Mozambique’s state entity for petroleum products), Galp and Korea Gas Corporation (KOGAS). Rovuma LNG Project’s majority owner is MRV, which itself is jointly owned by ExxonMobil, Ente Nazionale Idrocarburi (ENI) and China National Petroleum Corporation (CNPC).

ENI will undertake the construction and operation of offshore facilities and ExxonMobil will oversee onshore liquefaction facilities.

Project sponsors

Empresa Nacional de Hidrocarbonetos (ENH)

MozambiqueGalp Energia

PortugalKorea Gas Corporation (KOGAS)

South KoreaApplicable norms and standards

Mozambique existing and planned oil pipelines and terminals, with WDPA (World Database of Protected Areas) sites.

2022

2022-08-08 00:00:00 | Eni aims to reboot Rovuma LNG project with floating LNG facility

Eni has proposed to construct a floating LNG (FLNG) processing facility for the Rovuma LNG project to circumvent the political risks that have disrupted the construction of the onshore facilities and to fast-track monetization of the gas reserves in Area 4 of the Rovuma LNG project. TotalEnergies declared force majeure on its Mozambique LNG project in April 2021 after an insurgent attack close to the gas facilities. This also prompted ExxonMobil to postone FID on the Rovuma LNG project. Eni views the FLNG facility as a temporary fix to work around the violent and instable situation in the Cabo Delgado province.

2022-04-20 00:00:00 | Exxonmobil and ENI delay Rovuma project’s FID once again

ExxonMobil and ENI have further delayed the Final Investment Decision on their Rovuma LNG project after TotalEnergies declared force majeure on their Mozambique LNG project.

2021

2021-03-05 00:00:00 | ExxonMobil and ENI delay Final Investment Decision for the third time

For the third year in a row, the Rovuma LNG Project has been delayed. ExxonMobil cited the need to secure a power supply from TotalEnergies, who is operating the adjacent – and also delayed – Mozambique LNG project.

2020

2020-11-25 00:00:00 | Mozambique LNG resource-sharing deal being discussed by energy majors

ExxonMobil, Total and the Mozambican government are renegotiating how to best exploit a gas field that straddles the territories of both Exxon’s Rovuma and Total’s Mozambique LNG projects. The field in question will yield thicker gas, which makes it cheaper to extract and therefore suits both companies’ desire to cut costs.

2020-09-09 00:00:00 | DFC’s bumper global development investment includes Mozambican gas fields

The United States’ Development Finance Corporation has approved a USD 1.5 billion political risk insurance deal to support the development of the Rovuma LNG Project.

2019

2019-09-30 00:00:00 | Total purchases Anadarko's stake in Mozambican LNG

Total has acquired Anadarko's 6.5% operated interest in the Mozambique LNG Project for USD 3.9 billion. Cooperation between this project and the Rovuma LNG Project is expected to continue.

2017

2017-12-13 00:00:00 | ENI sells 25% of its interest in Rovuma LNG Project to ExxonMobil

ExxonMobil Development Africa B.V. is the latest co-owner of the Rovuma Basin Area 4 gas fields in Northern Mozambique. ENI East Africa, which owns 70% of the Area 4 concession, will be renamed Mozambique Rovuma Venture (MRV). MRV will be co-owned by ENI (35.7%), ExxonMobil (35.7%) and China National Petroleum Corporation (CNPC; 28.6%). The other 30% of Area 4 is co-owned by Empresa Nacional de Hidrocarbonetos E.P. (ENH; 10%), Korea Gas Corporation (KOGAS; 10%) and Galp Energia (10%).

2012

2012-12-21 00:00:00 | ENI and Anadarko sign Northern Mozambique LNG HOA

Rivals ENI and Anadarko have signed a Heads of Agreement (HOA) to work on exploiting Northern Mozambique’s recently discovered offshore natural gas reservoirs. In separate but cooperative projects, ENI will develop and operate facilities in Area 1, while Anadarko will oversee Area 4.

2011

2011-10-20 00:00:00 | Large offshore gas field discovered in Northern Mozambique

The Italian oil and gas giant ENI has discovered 425 billion cubic metres of gas off the coast of Mozambique. As well as ENI, Anadarko Petroleum Corporation has also been exploring the area since 2007.