Project – On record

This profile is no longer actively maintained, with the information now possibly out of dateBankTrack & Deep Sea Mining Campaign

Project – On record

This profile is no longer actively maintained, with the information now possibly out of dateBankTrack & Deep Sea Mining Campaign

Why this profile?

Update: As of September 2019 the Solwara 1 project has collapsed, with the project backer Nautilus going into administration.

What must happen

The Solwara 1 project will have a devastating impact on the marine environment and the health, livelihoods and cultures of nearby coastal communities. Financial institutions should steer clear of Nautilus and not provide funds for this high risk, experimental project.

| Sectors | Mining |

| Location |

|

| Status |

Cancelled

Design

Agreement

Construction

Operation

Closure

Decommission

|

| Website | http://www.cares.nautilusminerals.com/irm/content/solwara-1-project.aspx?RID=339 |

The Solwara 1 project, being developed by Canadian company Nautilus Minerals, is intended to extract high-grade Seafloor Massive Sulphide (SMS) deposits of copper, gold, zinc and silver from the Bismarck Sea, Papua New Guinea. The project is set at 1,600 metres water depth and if developed would be the world's first deep sea mining project. Solwara 1 is located approximately thirty kilometres from the nearest coast (New Ireland Province) and fifty kilometres north of the international Port of Rabaul (East New Britain Province).

The project is expected to start its operations in 2018. It has been granted an operating license by the Papua New Guinea Government without having been given free, prior and informed consent of nearby coastal communities.

Nautilus has no source of revenue and will need to raise additional equity, debt or joint venture partner funding to advance the development of the Solwara 1 project. Nautilus requires at least USD 125 million to USD 175 million and will need to approach the market to secure the funds it needs. Nautilus has not conducted standard economic assessments of the project and any financial supporter of Solwara 1 will find itself exposed to a high level of risk.

Social and human rights impacts

The lives of nearby coastal communities depends almost entirely on the sea. People have spiritual and cultural connections to the sea, and rely on the sea for their livelihoods. People fear that the Solwara 1 project will result in a loss of identity and livelihood.

The fishing grounds of coastal communities on New Ireland and East New Britain includes the site of the Solwara 1 project. Deep water fish such as tuna are caught at the Solwara 1 site and reef fish are caught at nearby reefs. These fisheries are an important source of both income and are the main source of protein consumed by local people. There is concern that metals and other toxicants from the Solwara 1 project will enter the food chain and have a devastating imapct on human health. Local communities strongly oppose the Solwara 1 project - they do not want to be guinea pigs in a dangerous experiment.

The Solwara 1 project has the potential to undermine people's right a livelihood, health and culture. Nautilus is proceeding with the Solwara 1 project without the free, prior and informed consent of coastal communities. The right to free, prior and informed consent is an important right itself and acts as a safeguard to protects other rights - such as to a livelihood.

Environmental and climate impacts

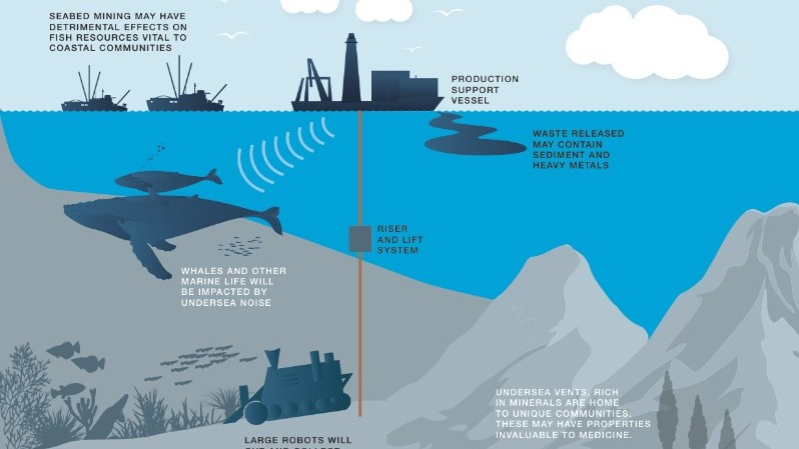

New research reveals experimental seabed mining could have a devastating impact on life forms that are 'literally saving the planet' and preventing a 'doomsday climatic event'. The research lists experimental seabed mining as a major threat to ocean life residing around hydrothermal vents which has been found to consume enormous quantities of methane that would otherwise enter the atmosphere. Source: Papua New Guinea Mine Watch. Read more here.

A study carried out between 2002 and 2007 estimated that there could be more than 1,000 species at a single site in the key region proposed for mining. According to the Global Ocean Commission, "mining at the seafloor will cause localized damage, including crushing living organisms, removal of substrate habitat and disturbance of sediment", with further environmental impacts during processing. They list rising demand for resources, technological advances and weak high seas governance as "drivers of decline" for the oceans (source The Huffington Post).

Several financial institutions have provided corporate loans or underwritten bonds to MB Holding and Metalloinvest (the two major share holders of Nautilus Minerals) or their subsidiaries since 2013. See below.

Note these banks are not involved with financing the Solwara 1 Deep Sea Mining Project directly. Rather, they are listed here as they are considered likely to be called upon to finance the project, given the stated financing strategy for the project, and because they should be in a position to engage with these companies regarding the risks of this project.

Also included financiers to MB Holding and Metalloinvest were: Central Bank of Libya, Oman Arab Bank, Uralsib (Russia), Blogettex Finance (Cyprus) and BK Region (Russia). In August 2016 Nautilus obtained bridge financing and restructured Solwara 1 project delivery (source Reuters).

Nautilus' significant shareholders (as per the company's website, accessed October 2018) are MB Holding Company LLC (30.4%) and Metalloinvest Holding (Cyprus) Limited (19.2%).

Nautilus Minerals

CanadaApplicable norms and standards

2019

2019-10-07 00:00:00 | Solwara 1 project collapses as Nautilus goes bankrupt

As of September 2019 the Solwara 1 project has collapsed, with the project backer Nautilus going into administration.

According to Mining Journal: "The company was unsuccessful to raise enough cash to successfully develop its Solwara 1 deepsea deposit. Working against it too was the pioneering nature of its project, and strong organised resistance from local and international non-governmental agencies who argue not enough is known about mining's potential impact on the ocean floor and surrounding water columns."

The Guardian reports that following the company's collapse the President of Fiji made a call for a 10-year moratorium on deep sea mining in the Pacific, which has been supported by the prime ministers of PNG and Vanuatu.

2018

2018-05-07 00:00:00 | Anglo American divests from Nautilus over risks of deep sea mining

Anglo American has exclusively confirmed to the Deep Sea Mining Campaign that they have exited their investment in the Nautilus Minerals Solwara 1 deep sea mining project.

2017

2017-12-08 00:00:00 | Legal action launched over the Nautilus Solwara 1 Experimental Seabed Mine

Coastal Communities have launched legal proceedings against the PNG Government in a bid to obtain key documents relating to the licensing and the environmental, health and economic impacts of the Solwara 1 deep sea mining project. Read more.

2017-10-03 00:00:00 | Constitutional Right to Key Documents on Experimental Seabed Mining

Coastal Communities in Papua New Guinea have formally requested that the PNG Government make public key documents relating to the licensing and the environmental impacts of the Solwara 1 deep sea mining project by October 18 or face the prospect of legal proceedings. “Very little information about the Solwara 1 project has been disclosed by PNG Government or the project developer, Nautilus Minerals”, stated Peter Bosip, Executive Director, Centre for Environmental Law and Community Rights (CELCoR). (source Deep Sea Mining Campaign).

2017-09-26 00:00:00 | Nautilus still seeking funds for Solwara 1 project

In a corporate update Nautilus stated that "the Company's current cash position and budget, in order to maintain the Company's operations and the development of the Solwara 1 Project, the Company needs to obtain new funding

of approximately USD 41 million prior to the end of 2017 and, in particular, at least approximately USD 15 million is required before October 31, 2017 in order to meet the Company’s contractual commitments in relation to certain of the equipment forming part of the seafloor production system." In a second press release Nautilus stated that two of its major shareholders are to assist in finding finance for the development of the Solwara 1 Project.

2016

2016-07-05 00:00:00 | Nautilus Minerals facing financial collapse

Canadian mining company Nautilus Minerals is facing a severe financial crisis that threatens not just its plans for experimental seabed mining in Papua New Guinea, but the future of the whole company. Nautilus says not only is it delaying any further project spending, it desperately needs short-term emergency funding to continue company operations to allow staff more time to look for ‘significant additional funding' or an ' alternative transaction aimed at maximising shareholder value'. Nautilus says 'there can be no assurances that the company will be able to obtain the necessary bridge financing or project financing on acceptable terms or at all. This may lead to suspending or terminating the development of the seafloor production system and the Solwara 1 Project.' (source: Papua New Guinea Mine Watch).

2016-06-29 00:00:00 | Press release Nautilus on the Solwara 1 project

Toronto Ontario, June 29, 2016 - Nautilus Minerals Inc. announces that, further to the Company's news release dated April 8, 2016, the Company continues to seek and consider various alternative sources of financing in order to maintain the development of the Solwara 1 project and the company's operations.