Project – On record

This profile is no longer actively maintained, with the information now possibly out of dateBankTrack

Project – On record

This profile is no longer actively maintained, with the information now possibly out of dateBankTrack

Why this profile?

The Vaca Muerta Shale Basin megaproject threatens both the rights of the Mapuche Indigenous community and the chances of a safe climate for humanity. If Argentina’s shale gas reserves are fully exploited, they will account for 11.4% of the world’s remaining 1.5°C carbon budget. Nearly all of Argentina’s shale gas and oil are located in the Neuquén Basin.

What must happen

Banks must not finance new oil and gas extraction projects in the Vaca Muerta Shale Basin. They must phase out their support for all existing fossil fuel projects and companies in the Vaca Muerta Shale Basin and beyond, on a timeline consistent with Paris Climate Agreement alignment.

| Sectors | Oil and Gas Extraction , LNG Terminal, Pipeline Transportation of Crude Oil, Pipeline Transportation of Natural Gas |

| Location |

|

| Status |

Planning

Design

Agreement

Construction

Operation

Closure

Decommission

|

| Website | https://www.ypf.com/desafiovacamuerta/Paginas/vaca-muerta.html |

The Vaca Muerta Shale Basin is located in Argentina’s Neuquén Basin, Patagonia. Covering 30,000 square kilometres, it is the largest known shale play outside North America. This oil and gas megaproject of pipelines and LNG terminals represents 43% of Argentina's total oil production and 60% of its gas production. Fossil fuels have been extracted here for decades, but Argentina nationalised Yacimientos Petrolíferos Fiscales (YPF) in 2012 to drastically increase domestic production. YPF then brought oil and gas majors such as Chevron, Shell and TotalEnergies to Vaca Muerta. Argentina also issued a 35-year transport concession to state energy company Integración Energética Sociedad Anónima (IEASA), to oversee Vaca Muerta’s USD 3.5 billion Néstor Kirchner gas pipeline. Argentinian energy independence aside, by the late 2010s increasing attention was being paid to Vaca Muerta’s export potential.

Impact on human rights and communities

Indigenous rights violations are at the heart of this project, because the Indigenous Mapuche community has not given free, prior and informed consent for Vaca Muerta Shale Basin activities to take place on their lands. The Mapuche's cultural identity is being denied with the purpose of refusing community legal rights and their ancestral lands are already irreversibly damaged.

Intimidation tactics have included a 2013 arson attack that destroyed an observation facility built by the Mapuche to track extraction activity. The attack took place during the same year that Chevron began fracking in the disputed Loma Campana oil field: In 2015, the Argentinian government acknowledged part of Loma Campana belonged to the Mapuche.

Public health violations have occurred during the removal of fracking waste. A 2018 lawsuit brought by the Mapuche against ExxonMobil, Total and Pan American Energy accused them of dumping toxic waste too close to the town of Añelo, Indigenous lands, as well as the region's principal river. By not being treated in accordance with the relevant laws, this waste contains high levels of elements that pose risks to human reproduction and respiration.

A general degradation of local life has accompanied the escalation of Vaca Muerta extraction work. Food and house prices in the area have risen, which are tied to oil and gas workers' salaries that do not represent the local majority. The population of Añelo city grew from 2,500 to more than 6,000 people in less than three years, forcing families with little resources to the outskirts of towns. This influx has also led to the trafficking of women and drugs into the area.

Impact on climate

Massive greenhouse gas emissions are set to grow at Vaca Muerta, backed by the government in its 2019 National Energy Plan: In order to make exports viable, Vaca Muerta extraction must double between 2022 and 2027, to 500,000 barrels of oil every day. The burning of Argentina’s total gas reserves alone would eat up 11.4% of the world’s carbon budget. Blowing this budget violates the Paris Climate Agreement’s core aim of limiting the average global temperature rise to 1.5C. Furthermore, methane leaks often occur during Vaca Muerta’s operations. Methane heats the planet at a rate that is 86 times greater than CO2 across a 20-year period.

Impact on nature and environment

The degradation of water, soil and air quality and public health are all outcomes of hydraulic fracking, according to a 2016 categorical assessment of peer-reviewed scientific literature. This extraction method is necessary to develop Vaca Muerta’s unconventional hydrocarbon reservoirs, but it makes use of several dangerous chemicals that are released during the process. Leaks of these chemicals have been reported at Vaca Muerta Shale Basin, causing pollution.

Oil spills occur often in Vaca Muerta. An average of three oil spills per day reportedly took place between January and October 2018. For example, a YPF-Schlumberger partnership operation was behind a Vaca Muerta shale well blow-out on 19th October that contaminated 85 hectares of land with oil and drilling mud; in November 2018, Argentinian authorities suspended the operator's licence.

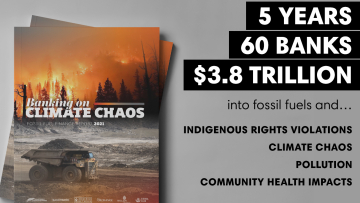

Banks finance Vaca Muerta operations in various ways, but mostly by financing the companies that are active in the region. This finance is made available through corporate loans, underwriting services or equity investments. Another way in which banks provide finance for Vaca Muerta operations is by working with companies on specific projects in the area. See below for more details on which banks are financing companies that have operations in the Vaca Muerta basin.

A long list of oil and gas companies are active in the Vaca Muerta Shale Basin. Argentina’s state energy company YPF is the area’s main actor, being involved in most projects either independently or in collaboration with others. Together, these companies extract 30% of Argentina’s oil and 45% of its gas annually across more than 1,000 drilling sites.

BP

United KingdomChevron

United StatesConocoPhillips

United StatesGas y Petroleo del Neuquén

ArgentinaPampa Energía

ArgentinaPan American Energy

ArgentinaPetrobas Energia

ArgentinaPetronas

MalaysiaPluspetrol

ArgentinaTecpetrol

ArgentinaVista Oil & Gas

MexicoWintershall

GermanyYPF

ArgentinaApplicable norms and standards

Map: Existing and planned oil pipelines, exploration and production blocks in Patagonia.

Equinor AGM 2023

Fracking is Hell: Allen and the YPF Trap

YPF drilled more than 200 wells in the Allen area and since then there have been explosions, spills and various accidents.

Socioeconomic implications of shale gas extraction in Vaca Muerta (Central Washington University seminar)

Case Study BOCC report 2021: Fracking in Vaca Muerta

How fracking is taking its toll on Argentina's indigenous people

2022

2022-10-12 00:00:00 | Argentina accelerates Vaca Muerta megaproject gas compression plans, launches tender

Argentine state energy company Energía Argentina has put out to tender another contract associated with the first phase of the Vaca Muerta gas pipeline megaproject.

2022-07-29 00:00:00 | Extraction activity reaches all-time high in Vaca Muerta

Argentina has seen a high increase in oil and gas production its Vaca Muerta Shale Basin. According to research by Rystad Energy, this new peak is part of a wider South American trend that could see the region producing more than 300,000 barrels per day by early 2023.

2022-03-10 00:00:00 | Activity levels rising in Vaca Muerta

Global energy data analytics and SaaS technology company Enverus anticipate that activity levels at the Vaca Muerta Shale Basin will keep climbing. YPF planned to spend USD 1.5 billion in 2021, PAE (Pan American Energy) will invest approximately USD 150 million into infrastructure by mid-2023 , while Shell intends to spend USD 1 billion to drill 100 wells during 2022.

2022-02-24 00:00:00 | Argentina seeks bids to build first phase of Vaca Muerta gas pipeline

The Argentinian government has launched tenders to acquire 656 kilometres of pipes for the Vaca Muerta gas pipeline’s first stage, the construction of which is forecast for completion in approximately 18 months. By winter 2023, this USD 1.6 billion project is expected to add 24 million cubic metres of gas per day to the country's network.

When complete, the full pipeline project will have added a 1,430-kilometre-long pipeline between the Vaca Muerta Shale Basin and Uruguiana in Brazil. From there, another 600-kilometre-long pipeline to the city of Porto Alegre is planned, facilitating distribution to southern Brazil.

2021

2021-09-20 00:00:00 | ConocoPhillips ceases interests in Vaca Muerta Shale Basin

The US energy producer ConocoPhillips has sold all of its interests in Argentina to Vista Oil & Gas. A local oil producer, Vista has acquired a 50% stake in two oil concessions in the Vaca Muerta field and all of ConocoPhilips Argentina’s capital stock. Neuquén’s regional government granted these concessions, which expire in 2050.

Vista chairman and CEO Miguel Galuccio: “This is a unique opportunity to strengthen our position as one of the leading producers in Vaca Muerta. We are not only adding core assets to our existing portfolio, further enhancing our growth potential and shareholder value, but will also contribute our know-how in efficient developments, as well as safe and sustainable operations.”

2021-02-26 00:00:00 | USD 45 billion in 23rd agreement between Argentina and IMF

The International Monetary Fund has approved a new loan programme for Argentina, granting the country more time to repay a debt of USD 45 billion. The agreement includes a series of fiscal and monetary targets designed to help stabilise Argentina’s economy and widen access to international financing. If Argentina’s congress ratifies the deal, debt repayments will recommence. Full repayment is scheduled for 2034.

Vaca Muerta development plans will reduce Argentina’s gas imports, but they also require huge investment; the existing infrastructure is only suitable for some oil expansion, but not natural gas.

2020

2020-09-02 00:00:00 | Redeployment of rigs underway at Vaca Muerta

Argentina’s state-backed energy company, YPF, will be redeploying 46 rigs in the Vaca Muerta Shale Basin between October 2020 and February 2021, following a plunge in oil and natural gas production due to the COVID-19 pandemic.

2019

2019-09-17 00:00:00 | Vaca Muerta granted military police protection

Argentina’s Ministry of Security has placed the Vaca Muerta Shale Basin under the jurisdiction of the military police force, in response to growing union, environmental and Indigenous protests in the area.

2013

2013-07-17 00:00:00 | YPF and Chevron sign Vaca Muerta deal worth USD 1.24 billion

In a move intended to open up the Vaca Muerta Shale Basin to global oil and gas markets, YPF has secured its first major international investment deal since Argentina’s government took control of the energy company in 2012. Chevron’s USD 1.24 billion investment in the region is designed to be the first of many, in a bid to reverse Argentina’s declining domestic oil and gas production.